Don't want to miss a thing?

To better understand the challenges facing the European TV industry, MTM and SoftServe spoke to senior executives from a range of broadcasters, agencies and trade bodies:

The European TV Market is growing, but broadcasters must innovate to compete

Western European TV revenues are growing, rising from $39 billion in 2017 to an estimated $50 billion by 2023 . Executives think we are in the ‘Golden Age of Content’ with larger budgets, more talent, and more opportunities to reach audiences. Consumption now occurs across multiple devices in many locations. Broadcasters have rolled out their own over-the-top (OTT) streaming services and, in some cases, are now looking to launch their own premium direct-to-consumer (D2C) services. They are experimenting with virtual reality, customisable interactive content, 8K HDR viewing, hyper-personalisation, and automatic filming. In terms of content, European broadcasters have had a global impact, too, with successes including Killing Eve, Broadchurch, Deutschland ’83, The Bridge, and Spiral.

However, the landscape is changing. International subscription video-on-demand (SVOD) services, dominated by American giants such as Netflix and Amazon, continue to capture viewing share, with SVOD use rising 22% year-on-year in the UK . Audience behaviour is shifting towards on-demand content, with many 16-24-year olds turning to these services first, rather than linear channels . Disney, Time Warner, NBCU, and Apple have all announced streaming services. Facebook and YouTube are producing and distributing content through proprietary platforms, and Amazon and Twitter are purchasing sports rights. These companies, often born in Silicon Valley, are data-first and digitally native. They do not have cumbersome legacy platforms to maintain; and innovating through technology is in their DNA.

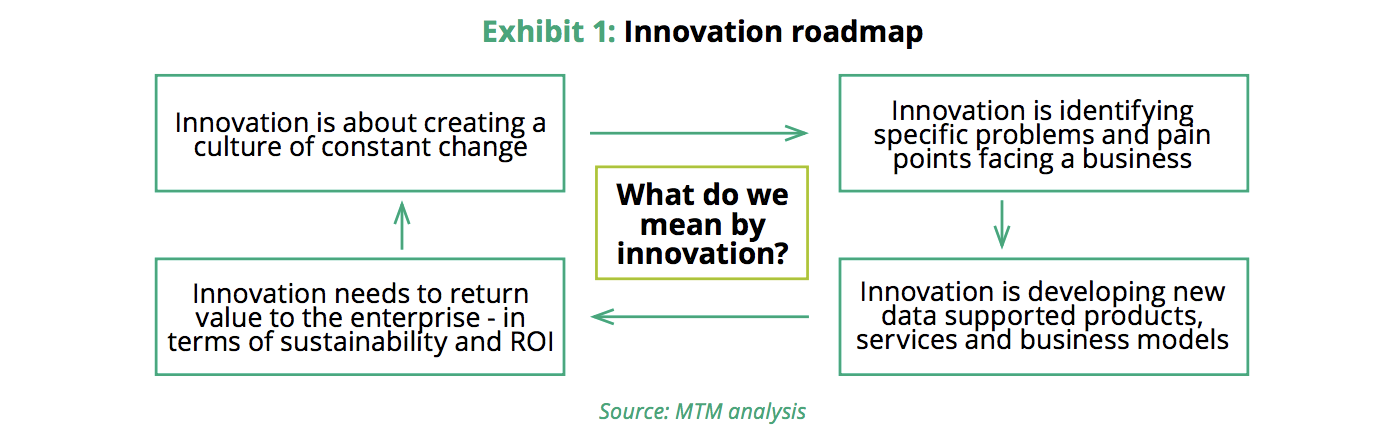

How can European broadcasters respond to these challenges? What are some of the key pain point facing European broadcasters today as they seek to transform their businesses? What areas of innovation should European broadcasters focus on? How can the video value chain benefit from new technologies on the horizon, including artificial intelligence (AI) and machine learning (ML)? What other innovation imperatives exist for European broadcasters? Who is best placed to deliver the solutions required?

MTM has partnered with SoftServe, digital advisors and providers who operate at the cutting edge of technology, to explore the issues facing European broadcasters, and the types of innovation required for them to compete.

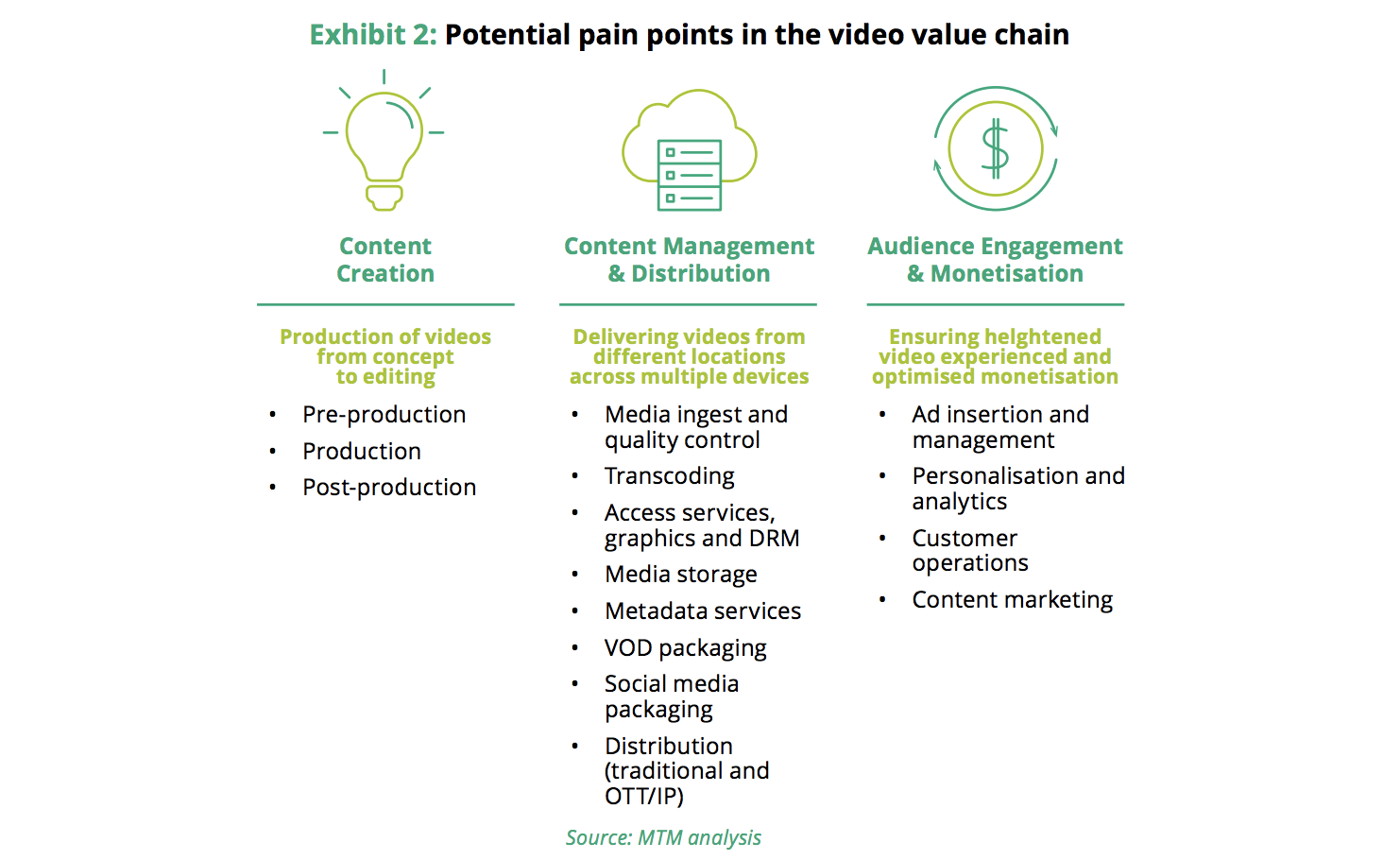

European broadcasters face challenges in three key stages of the video value chain

From speaking to industry participants, we identified three critical stages of the video value chain where European broadcasters must look to innovative technologies in order to respond to new challenges:

This video workflow value chain surfaces multiple pain points for broadcasters. Many of these areas present complex challenges: from migrating workflows to the cloud to optimising existing workstreams; from establishing a hygienic data set to replacing legacy systems; from deciding where to invest, partner or develop in-house, to building direct relationships with viewers. None of this is easy, and most are outside broadcasters’ traditional skillsets.

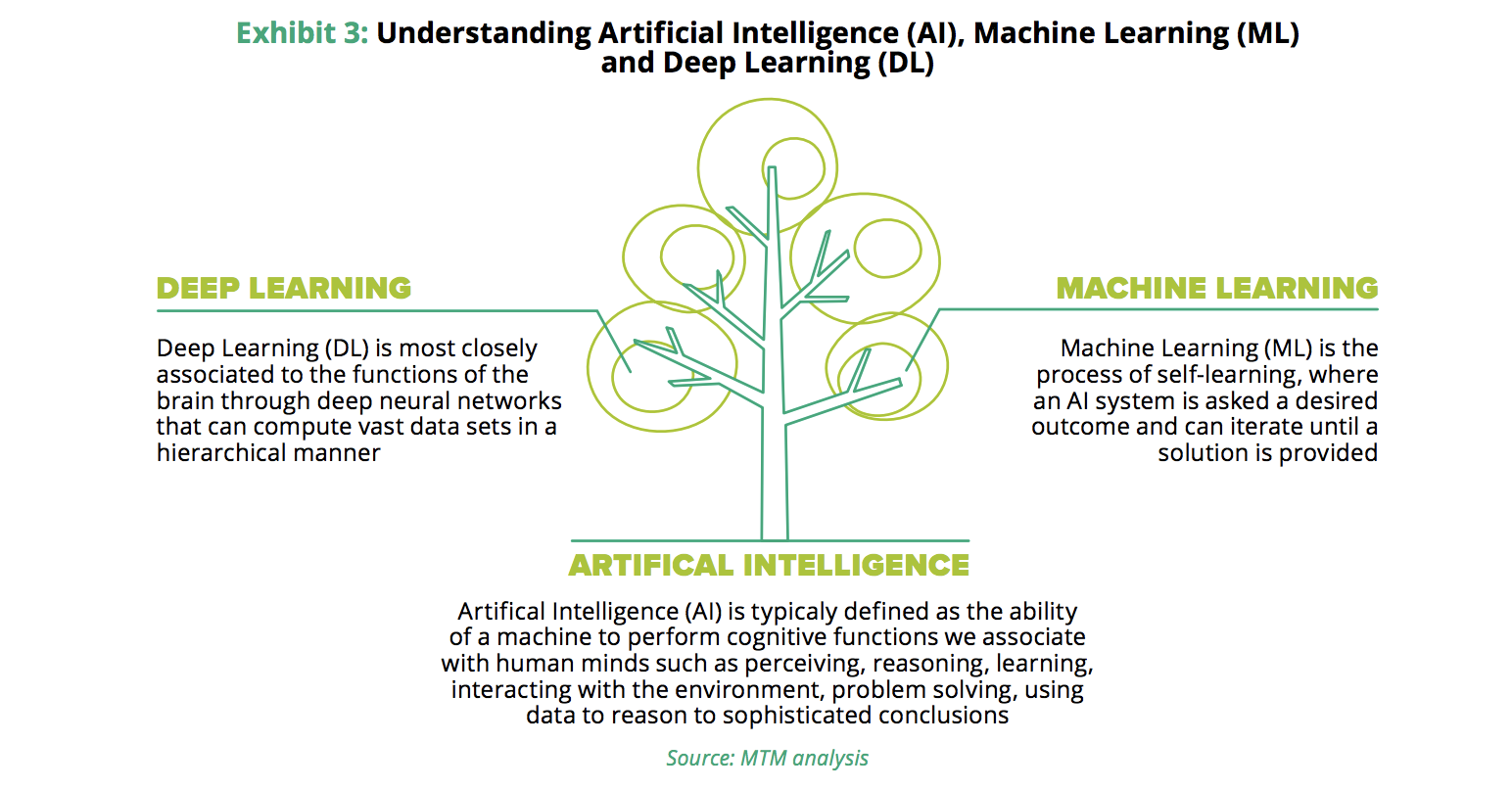

We spoke to a number of senior executives in the European TV industry to explore these high-level issues, and the impact of innovative technologies such as artificial intelligence (AI). We define AI as machines performing cognitive functions through computing large volumes of data to reason to sophisticated conclusions (see Exhibit 3). With 80% of media executives believing AI is the next industrial revolution, understanding its impact on the future of broadcasting will be critical to its long-term success.

“We are at the tipping point where we are seeing [AI / ML solutions] move from hype to actually driving real value" – Trade body

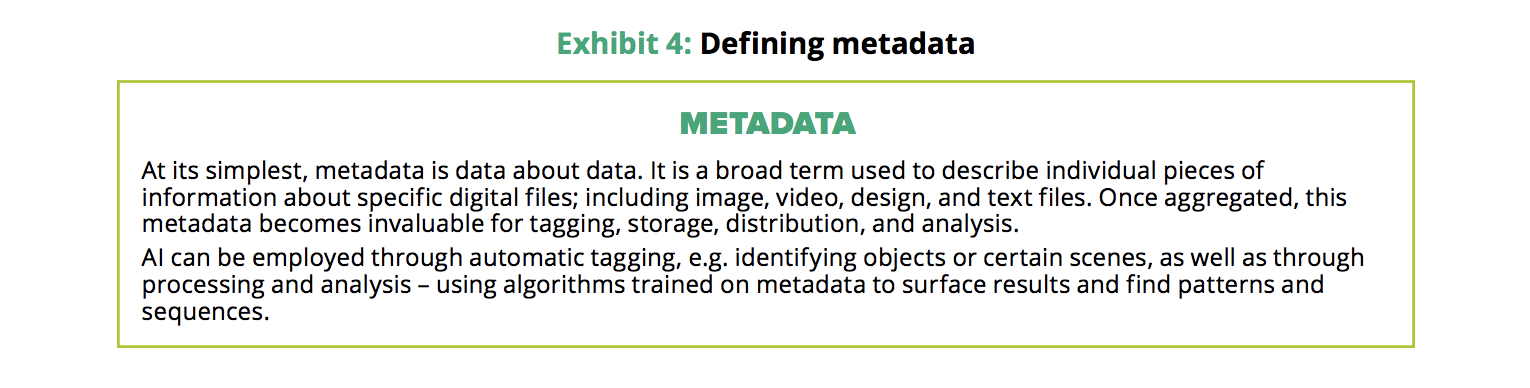

Our executives identified metadata as an area ripe for innovation. Having the correct data about content enables broadcasters to create valuable new insights across all the areas of the value chain - content production, management, engagement, monetisation, and analysis.

Download the full version to learn more.