Out with the old, in with the new.

Such is the case with FinTech firms and existing financial institutions like banks and credit unions. Instead of viewing disruptors as competitors, financial services companies—especially global conglomerates who lack the agility needed for innovation at the speed of digital—should embrace collaboration to enhance service and experiences for today’s digital consumer.

Major players in the industry that have been quick to adapt, do not view the exponentia l growth in popularity of FinTech firms to be a challenge, but rather, an opportunity.

When the longevity, product variety, and customer base of financial institutions is combined with the data enrichment, user experience, and modern platforms that quality FinTech firms provide—the results can be highly beneficial for both the consumer and collaborators.

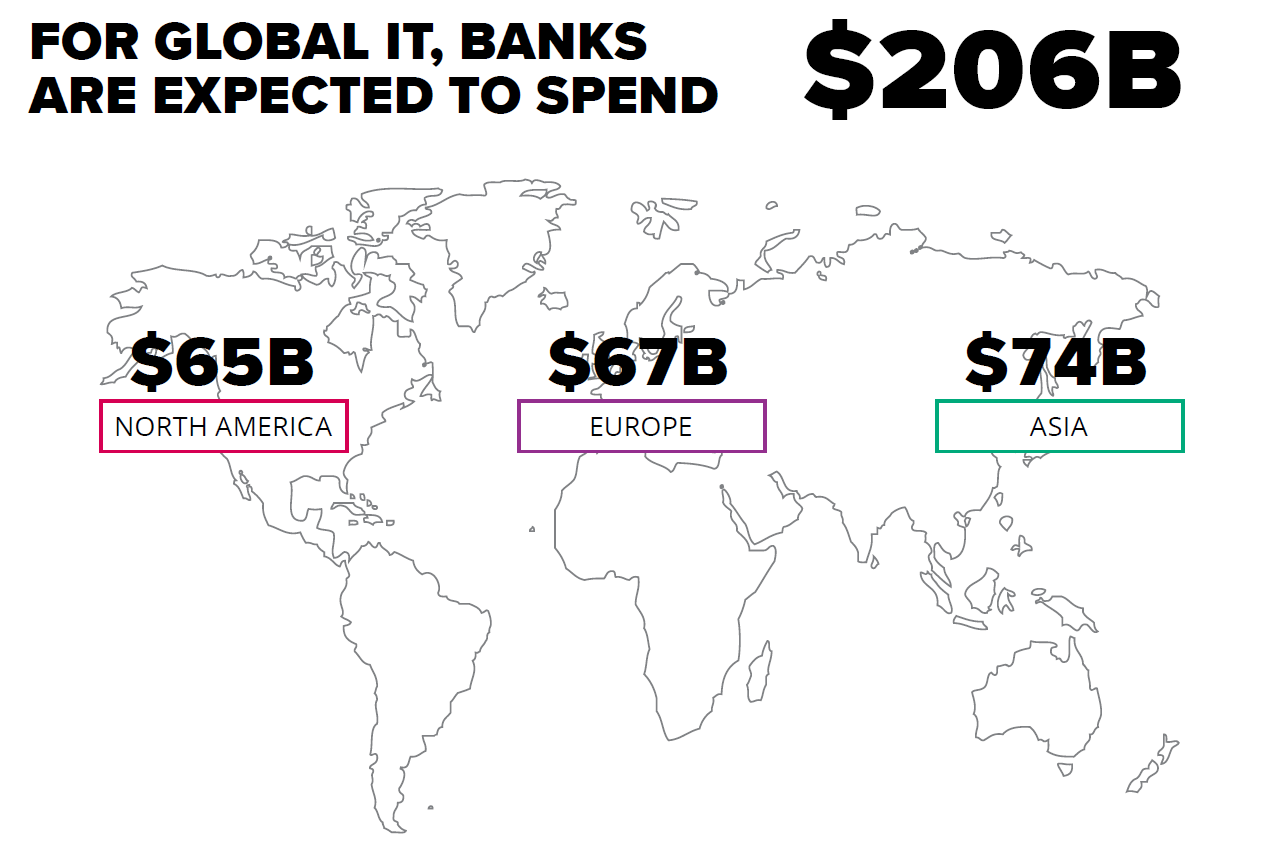

Based on projected technology investments for 2018, the benefit of FinTech integration with legacy systems is not lost on the financial establishment.

FinTech AI drives diversification (and lowers costs)

By 2020, 85% of all customer interactions will be accomplished without human intervention. At first glance, AI-driven teller/advisor automation may seem anti-collaborative, but in fact, it frees human assets to focus on non-redundant tasks while enhancing personalization and portfolio diversification.

RoboAdvisors and automated wealth management services provide clients with the financial advice they require and have become popular for people looking for low-cost and automated investment opportunities.

Within minutes, RoboAdvisors can provide a personalized portfolio and provide access to wealth management services that could only be previously accessed by the ultra-wealthy. These AI-driven service providers also build diversified portfolios, automatically selecting investments for their clients. It’s estimated that assets under management by RoboAdvisors will grow by 68% annually to $2.2 trillion within the next five years.

Automated trading lowers tax liability for financial services companies as well—yet another reason to embrace FinTech integration.

Why not both?

While disruptive to the status quo, FinTech (and digital innovation as a whole) should enhance, not replace traditional institutions. Some global conglomerates have taken the approach of competing with more agile FinTech providers, but likewise, this does not signal the end of FinTech startups. If one listens to and observes what consumers want for future banking, it’s both.

A survey from JD Power shows that the digital-savvy millennials still value the local bank branch. 71% still access the local branch with an average of 11 visits per year. Having access to both digital accounts and local branch access with fast, convenient, and personalized experiences is the key—and that is more effectively accomplished with legacy and FinTech integration.

Dominant financial players and FinTech firms can enhance each other’s strengths while covering respective weaknesses. Current efficien cy, security, and data management concerns can be turned into opportunities. For those that innovate collaboratively, the future of legacy and FinTech financial services is potentially more bullish than ever.