Don't want to miss a thing?

Are Banks Ready to Move Forwards with IBOR Transitions?

Authors: Ivan Leshko, Anton Kaidorin

The growing pressure arising from public health and economic concerns failed to stop the banking industry’s transition to Interbank Offered Rate (IBOR) replacements. It’s now become a known fact that many banks are planning to complete IBOR replacement projects by the end of 2021.

One major problem that banks often face is there is not one single IBOR deadline—the deadline keeps changing.

As the end of 2020 approaches, banks must start supporting new products. Banks are also obliged to enter a new risk-free rate in all new contracts that are issued, latest by the final quarter of 2020. Now, banks need to prove to banking regulators that they are moving at an acceptable pace from the IBOR to similar international equivalent standard, including the United Kingdom’s Sterling Index Average Rate (SONIA).

This is just one milestone, which is the same for U.S. dollars and Euros. In short, banks have to stop making assumptions and work at the same time to avoid discrepancies. Banks only have a year (2021) to prove their readiness to the regulators. Unfortunately, for some banks, the regulators plan on seeing a pre-cessation trigger for IBOR by the end of 2020.

Considering the current situation, who can be ready for multiple factors? For instance, what’s the approach banks will adopt to deal with non-performing loans? Isn’t dealing with this complex issue along with the IBOR transitions going to put a lot of pressure on the bank’s performance and resources? The banks have too much on their plate as of now.

If any bank fails to support non-IBOR products by the end of 2021, then they are likely to be in trouble and face challenges. In line with the following policy, it has more become a competition between banks supporting IBOR transitions and those who do not as of now.

RESEARCH AND ANALYTICS

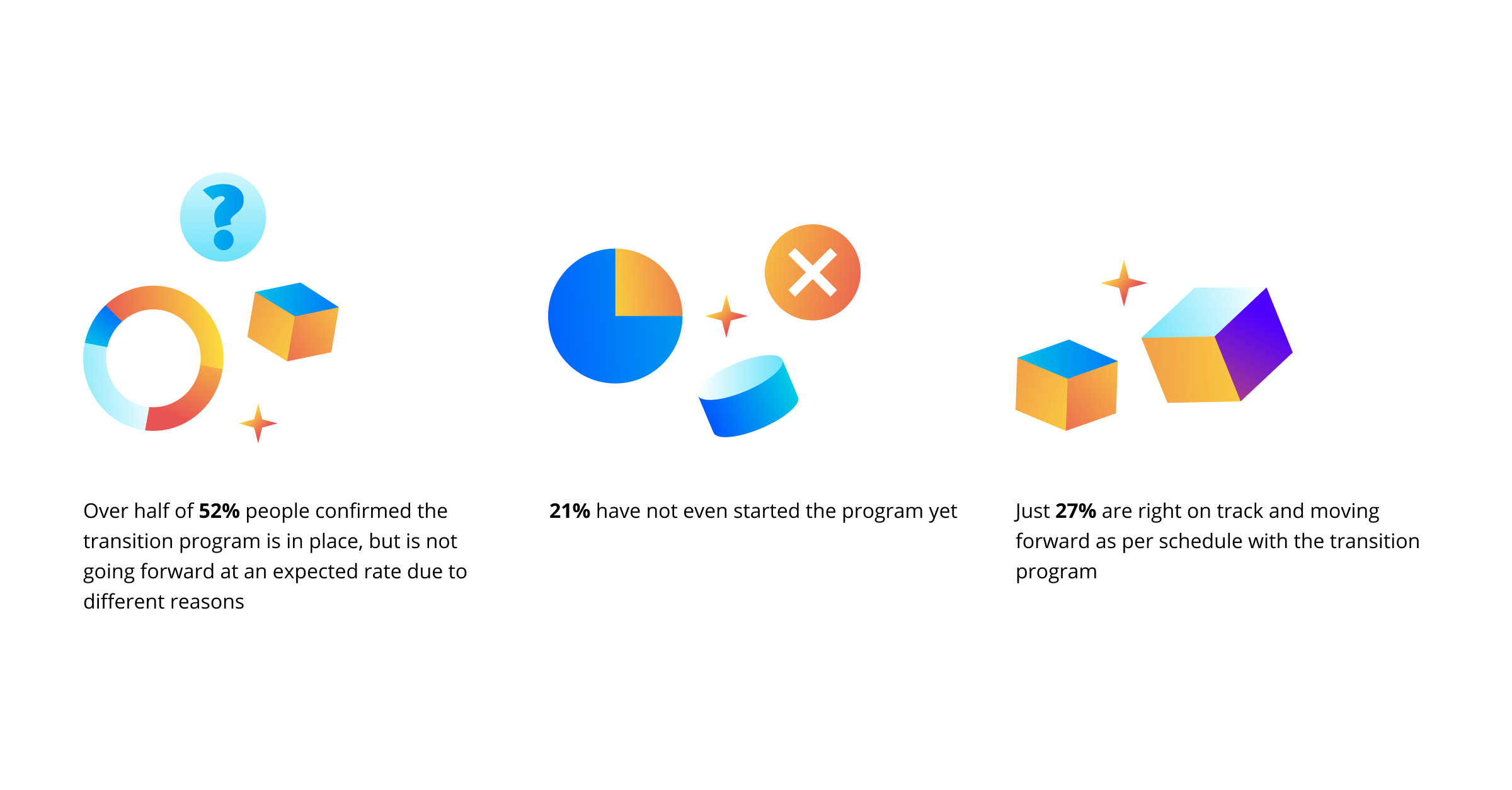

Looking at the deadlines, one can suggest that regulators are in a hurry, but are banks lagging behind or on the track? Although many banks have adjusted to working remotely, there are still some that require a lot of work in this space. The results of multi-dimensional analysis are enough to showcase and back this point. The main topic for SoftServe's Financial Services team was the ‘IBOR transition in the COVID-19 era’ and an expert research showed the results:

By the way, lockdown has put a major impact on the IBOR transition programs, which were going just fine before the pandemic.

With the on-going corona crises, banks have laid off many employees to cut costs. Although it may seem the right option at the moment, once the crises is over, banks may find it hard to find skilled individuals. Similarly, with a lot of people working from home, the hiring process can be slower than expected.

When the overall process of IBOR replacement demands solid efforts and deep expertise, banks need more resources to make the process functional and to deliver the results on time. Unfortunately, with a pandemic, it does not seem to be happening.

BANKS HAVE TO MAKE ACTIONS NOW

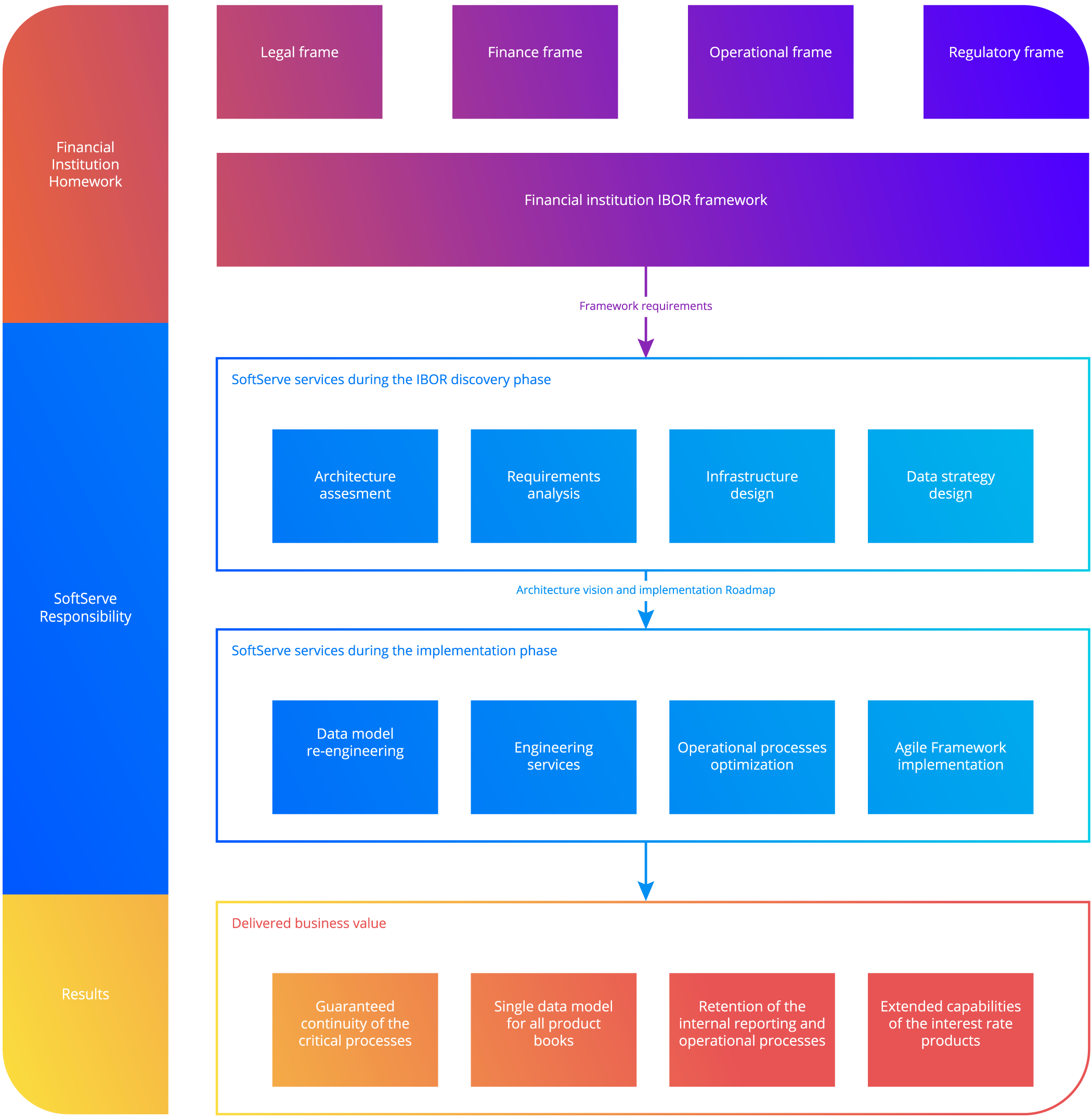

Banks face many problems and SoftServe has a few solutions to help solve the problem through multiple dimensions.

Strategic Focus

First of all, banks have to renew their application strategy to become modern organizations in line with the new reality. Ask key questions, such as:

- Does the bank have a proper IT strategy?

- Are the existing platforms and applications able to work with complex data challenges?

- Do you have platforms which are based on microservices or application architecture was designed for the cloud?

The key point is to focus entire IT strategy for the future.

Focus on Agile Practices

Agile practices enable banks to deal with unpredictable changes and ambiguity. Hence, IBOR replacement is the best time to adopt/expand these practices. Furthermore, agile practices help in engaging cross-functional teams for a better outcome.

Customers Experience

It's the bank's duty to educate the customer regarding the transition and its impact on them. Treating end-customers fairly in the whole situation is known as conduct risk. Banks must ask customers basic questions:

- Are you providing training to your relationship managers or sales team, so they can educate your customers?

- Are you satisfied with the information you are providing to your customers?

- Are you satisfied with the informational channels of your bank?

Software Adoption

As we said above, banks are moving around to fit the needs of the customers. One way to deal with it is by migrating to the cloud, build hybrid clouds or change the mode to a more FinTech type, like Software-as-a-Service (SaaS) to encourage future adoption. The modern-day technique which SoftServe recommends often to banks is an upgrade for the whole system based on agile practice and assisting the customer experience during the adoption phase.

Partner in place

Otherwise, banks need to consider two options relocate resources from existing internal programs or look for IBOR partner. Banks have to approach two directions and build a solid partnership to the technology and services partners at the same time. It will lead to saving costs and speed-up the overall project pace.

LIBOR SUCCESSFUL CASE

To understand it better, let’s take an example: one of a bank’s transition program, which SoftServe was leading.

Project started with the Discovery phase. SoftServe's experts, using regulations analysis, executed independent analysis of the potential business threats to the bank’s processes and corresponding technical threats to the upstream and downstream systems.

As the results, the Discovery phase allowed to:

- Define business divisions and processes under critical threat

- Design requirements to the existing origination and servicing systems of the bank

- Execute "as-is to-be" gap analysis of the existing and new data model of the data warehouse and corresponding data flows

- Implementation roadmap aligned with the strategic goals of the LIBOR (London IBOR) program

Note: the bank did not consider such wide coverage of application upgrade, but projects demonstrated that it was not focused on transition only, but also to make their system able to adapt to new changes.

Today the scope of uncertainty for the banks is so wide, they need to stay updated; otherwise, the IBOR transition is bound to get slowed down. Although remote working is a problem of now, that must not affect the IBOR transition at any cost. Working on the above-mentioned practices, SoftServe enables banks to solve such complex issues.

IS THIS THE END OF A JORNEY?

Banks must be ready for the very natural process of change management, especially when faced with resistance from the management in the two most prominent areas:

- One major area of resistance is of resources in terms of changing roadmap and priorities which will lead to new deadlines, budgets. This is very critical aspects as existing crisis already introduces too many unexpected changed. The complexity of the situation will slow-down change management process at the bank. Although there is uncertainty, the bank regulators are concerned about the IBOR replacement transition more than ever and if the bank failed to show results. SoftServe has developed a proven IBOR solution to help the banks walk through the change management journey and keep IT budgets and timelines at defined level. Making things clear with all parties and the bank can understand the severity of the problem at hand it.

- The second critical area of resistance is agile for development practices which we mentioned above. The advantages of agile practices are not unknown, agile implementation is often difficult for banks.

SoftServe has its own Abiliton Agile Framework for banks. This framework helps to remove barriers such as implementation risk management, governance, and control’s the pace and speed for deadlines. As the banking industry evolves with time, practices will allow banks to stay updated and follow a iterative approach which is flexible and adoptable to regulation needs.