Don't want to miss a thing?

Building a Blockchain-Based Exchange Platform for Invoice Trading

Partnering with SoftServe, our client’s goal was to build world’s first invoice exchange platform leveraging blockchain technology.

Business Challenge

There are several challenges associated with creating a marketplace exchange to buy and sell invoices. The majority of the financial assets, including invoices when traded in classic trading exchanges or marketplaces, cannot be sold right after they are bought by the investor. The investor has to keep the asset until the day of maturity. These can only be traded in fiat currency.

The client wanted to redefine the invoice financing practice by introducing the exchange that enables both parties to actively trade (buy and re-sell) assets purchased at initial marketplaces with no timing restrictions.

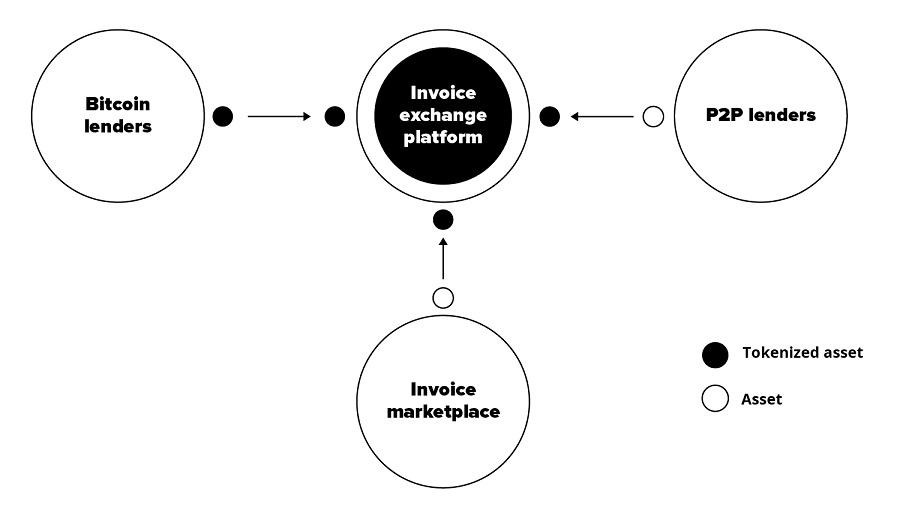

This solution aimed not to compete with banks and alternative financial bodies, like P2P lenders, but instead planned to treat these g roups as customers.

Project Description

Initially, the client created the marketplace where business owners could obtain cash flow investment by placing their invoices for investors to be bid for them. Investors could allocate their free resources by ‘buying’ the part or the whole invoice amount (or other asset) placed at the market. The marketplace was created to provide easy access to capital for small and middle business and give investors one more instruments to manage their free resources directly.

The client wanted to make this process even more secure, transparent and easy to use for all parties involved; and to speed the turnover of the capital by enabling reselling of the assets before their maturity date. The blockchain technology was chosen to support these requirements when building a new solution.

The client partnered with SoftServe to develop the first-to-be exchange for invoices based on blockchain. Their solution optimizes the use of DLT (Distributed Ledger Technology) within the blockchain to augment invoice trading and provide anyone with the opportunity to easily trade invoices or other assets on the blockchain.

The developed platform behaves like a stock exchange, where investors from all walks of life can trade any crypto assets such as an invoice, inventory, trade contracts, shares, etc. The exchange employs the tokenization system, and only tokens with strong tangible back up from the real economy can be traded (i.e. trade receivables, inventory, business loans and other tradeable assets).

The investor can buy the whole asset or invest only in a part of it. This is called a crowdfunding approach for an invoice. It increases the utilization of the free capital available at the exchange and the quantity of satisfied requests for the investment from the businesses. The exchange trade receivables agreements (ETRA) authorize the trade interaction between investors (invested in the invoice) and businesses (who placed them in the exchange) by stating the ownership of the asset. The agreement is an example of the asset that will be tokenized to be traded in the platform and the agreement circulates in the exchange until it is finally paid by the buyer.

The platform architecture is based on a smart contract and provides full transparency of events along with supply chain. It increases process efficiency, reduces risk of fraud and dramatically lowers costs.

The smart contract design follows a modular contract structure making it highly reusable and easy to upgrade. Transaction metadata is available only for entities that are authorized to access it.

Value Delivered

As this solution was built from scratch, SoftServe worked closely with the client to identify their business needs, define an approach to platform implementation, and conduct a security assessment for the architecture and smart contracts implemented in the platform.

SoftServe, as a partner, was responsible for developing the innovative solution that yields numerous benefits for all involved parties, including:

- Providing easy access to extra liquidity - parties such as P2P lenders, crowd funders, and recently emerging crypto funding players can all benefit from the liquidity offered by the platform.

- Interaction acceleration - the marketplace acts as accelerator that will stimulate trade, create interest among investors and help get invoices fully funded. Investors can sell their invoices or other assets on the exchange rather than wait several days for the asset to mature.

- Improving the world’s trading infrastructure – invoices bought from alternative finance marketplaces around the world are traded on the platform.

- Built in blockchain technology guarantees fast settlement speed, asset tokenization, transparent rules of trade and provides an asset management infrastructure to all ecosystem participants. This also allows collective management use cases, reduces trade costs, improves the overall trading infrastructure, and guarantees security against unauthorized history or account changes.

- Openness and engagement for all types of investors – trading in any fiat and cryptocurrency, including Bitcoins and Ethers is allowed.