Don't want to miss a thing?

APAC Finance Leaders Agree New Data Strategies Needed in the Age of Agentic AI

SoftServe recently hosted an exclusive executive dialogue that brought together C-suite leaders from financial institutions for a candid, high-level conversation. The discussion focused on how firms can maximize opportunities and minimize risk amid the evolving intersection of data management, AI, and governance.

Moderated by Tamara Singh from Elevandi, the debate explored how financial institutions need to rethink their data strategies to remain competitive in this rapidly changing landscape, where small language models and agentic AI are redefining what’s possible.

Data governance

At the heart of the conversation was a recognition that data governance is no longer a simple compliance task, it’s the backbone of responsible AI adoption. As one executive pointed out:

However, the discussion revealed a tension between data governance and operational realities. With many institutions operating in silos, the prevailing view was that data management needs decentralization as business units, not just the CDOs, should own their data. It was also acknowledged that this is challenging as many companies often behave like collectors and hoarders, storing data without fully understanding its quality or relevance.

Fragile foundations

Despite the AI revolution moving so quickly, many leaders acknowledged that the foundations needed to support AI initiatives — clean, accessible, and governed data — are still underdeveloped. One executive put it bluntly:

In a recent study commissioned by SoftServe, 98% of financial institutions acknowledged that their data strategies need to be updated before Gen AI can deliver its full value. Yet, many are rushing ahead, diverting resources to Gen AI initiatives instead of addressing basic needs.

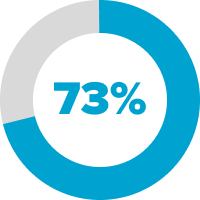

Not surprisingly, 73% of organizations admitted they are neglecting foundational data efforts.

Agentic challenges

One of the most striking takeaways from the discussion was a recognition that agentic AI — systems capable of autonomously taking actions and making decisions — raises stakes far beyond traditional robotic process automation (RPA). One participant remarked:

The challenge with agentic systems is not just about technological readiness, but also privacy, ethics, and accountability. As one leader pointed out,

Responsible AI

At SoftServe, we see ways to resolve this “data-AI gap” as an opportunity to help financial institutions align their data strategy with business value. Through our work with key regulatory bodies and our ongoing partnership with AI Verify, we’re empowering organizations to build data strategies that are not only future-proof but also aligned with global AI governance standards.

As a founding member of IMDA’s AI Verify Foundation, SoftServe has co-developed tools like Project Moonshot, a toolkit designed to evaluate the ethical deployment of large language models (LLMs). Collaborations like these help us ensure for clients that AI solutions are not only compliant with regulations but also promote ethical transparency and responsible innovation.

Unified approach

Key takeaways

To conclude, those gathered agreed certain steps need to be put in place to mitigate the risks of these powerful new technologies, while still reaping the benefits that they offer. The key points they would be taking back to their organizations were:

Decentralized Data Ownership: Empower business units to own and manage their data but equip them with the right governance frameworks.

Build AI on a Solid Data Foundation: Ensure that data is available, clean, and integrated before launching AI initiatives.

Agentic AI Requires Strong Governance: Develop clear ethical and privacy guidelines to mitigate the risks of autonomous systems.

AI and Data Must Work in Tandem: Build a unified strategy where mature data fuels better AI, and AI creates new ways to unlock value from data.

Partner power

As organizations look to scale their AI initiatives, SoftServe offers the frameworks, tools, and expertise to help bridge this “data-AI gap.” We empower leadership to implement robust AI strategies that are both compliant and responsible through tailored workshops on AI governance, risk mitigation, and data-driven decision-making.

With AI Verify-aligned solutions and a deep understanding of the financial services landscape, SoftServe is then strongly positioned to help institutions drive business value on the journey to data maturity and AI governance.

The road ahead for financial services will require collaboration across departments, partners, and regulators. By aligning your data strategy with your company’s AI vision and defined business use cases, financial institutions can then unlock sustainable, responsible AI that drives both long-term growth and compliance.

Start a conversation with us