Don't want to miss a thing?

Graph Neural Networks Will Strengthen Fight Against Financial Fraud

Banks and other financial institutions are being forced to deploy more advanced defenses, as the threats of financial fraud become increasingly sophisticated. Many finance firms have already embedded AI and machine learning tools to combat these attacks. But the evolution of graph analytics and neural networks is now providing them with a new advantage in these battles.

Concern about fraud among banks and their customers has been rising sharply, as have the costs of remedying it. The Federal Trade Commission estimated that consumer losses related to fraud rose by more than 30% in 2022 in the U.S. to $8.8 billion. Similar rises are seen in other regions around the world. Some estimate that the price of resolving these frauds is costing banks four times the amounts involved.

It is clearly a situation where drastic solutions are required.

Advanced analytics

A new edge is now being provided by graph analytics, which are advanced analytical methods that involve leveraging the relationships between different data points to generate more sophisticated insight for bank gatekeepers. It's particularly powerful in fraud detection because of its ability to identify complex patterns and structures that may not be easily identifiable using traditional data analysis techniques.

The success rate of graph analytics is further enhanced by the addition of neural networks that give near real-time intelligence from diverse nodes of activity. These outcomes become increasingly successful over time, as the more data that is fed into them provide better predictions. Meanwhile, new threat patterns that are identified can be instantly shared across the network.

So, what are the main challenges of bank fraud detection and what are the pros and cons of existing approaches to address them? Some of the common key issues are:

Evolving Risks

Fraudsters are collectively resourceful and creative and always find new pathways to their goals when one pathway closes.

False Positives

Fraud detection processes must be able to distinguish paying customers who contribute to your ROI from fraudsters who steal from it.

Optimizing Customer Journeys

Minimizing customer friction caused by the collection of personal identifying information and the introduction of new touchpoints for fraud prevention purposes.

Data Hygiene

The establishment of a central, well-labeled pool of customer data makes training AI fraud detection models much more effective and cost-efficient.

Common approaches

Fraud detection involves identifying anomalies, irregularities, or patterns that might indicate fraudulent activities. The rise of digitalization, machine learning, and AI has led to these techniques being increasingly used in fraud detection with these most common approaches.

Rule-based

As the name suggests, these systems rely on hard-coded rules that are set to flag transactions if they meet certain criteria. Such rules follow industry best practices. These include blocking multiple transactions from a single account in a short period or trades coming through VPNs or other potentially risky areas. These then develop new rules to cover their suspicious characteristics.

The advantage of this is that it offers full transparency out of the box so that if a certain rule triggers an alert for a particular transaction, it is immediately clear why this happened. There is no cold start problem, as they are operational from day one.

Lastly, there is a low threshold of entry that doesn’t require a team of data scientists, engineers, or MLOps. The first rules can be easily implemented by the backend team that is already familiar with translating business logic into code.

Of course, there can be some disadvantages as there is a continuous need to reverse engineer after fraudster attacks, with new rules developed as additional fraud patterns emerge. There are an incremental number of rules, which means the cost of maintenance can grow due to the need to recalibrate.

These techniques identify those fraud cases with limited complexity, as there is a limit on the number of rules and transaction features. Rule-based systems are further limited by human comprehension due to the manual development of rules and necessary maintenance tasks.

Machine learning-based

ML models in fraud prevention excel in data-rich environments, surpassing rule-based systems. They use algorithms like decision trees, random forests, gradient boosting, or neural networks to uncover intricate, non-linear patterns using numerous transaction features. Deploying these necessitates high-quality labeled historical data as a training dataset. The more data available, the better the model performs, maintaining detailed records of past transactions through feature vectors.

The advantage of this is automatic fraud pattern recognition as algorithms handle the task of identifying fraud, requiring detailed descriptions in the form of feature vectors. There is also concept drift resolution, where retraining models on new data addresses the changes seen in fraud characteristics, eliminating the need to reverse engineer fraudsters' methods.

Manual work is also reduced as automation streamlines processes, enabling companies with mature ML pipelines to focus on researching new features and algorithms, while monitoring current model performance. This leads to economic efficiency as ML models become more efficient as data volume and complexity increase, making them more viable than developing rule-based systems for fraud detection.

Of course, there can also be challenges with ML deployments, particularly “cold starts” where the running of ML models necessitates a significant amount of historical data. There can be a lack of transparency out of the box as some algorithms provide predictions without clear explanations, acting as "black boxes" with no straightforward link between inputs and outputs.

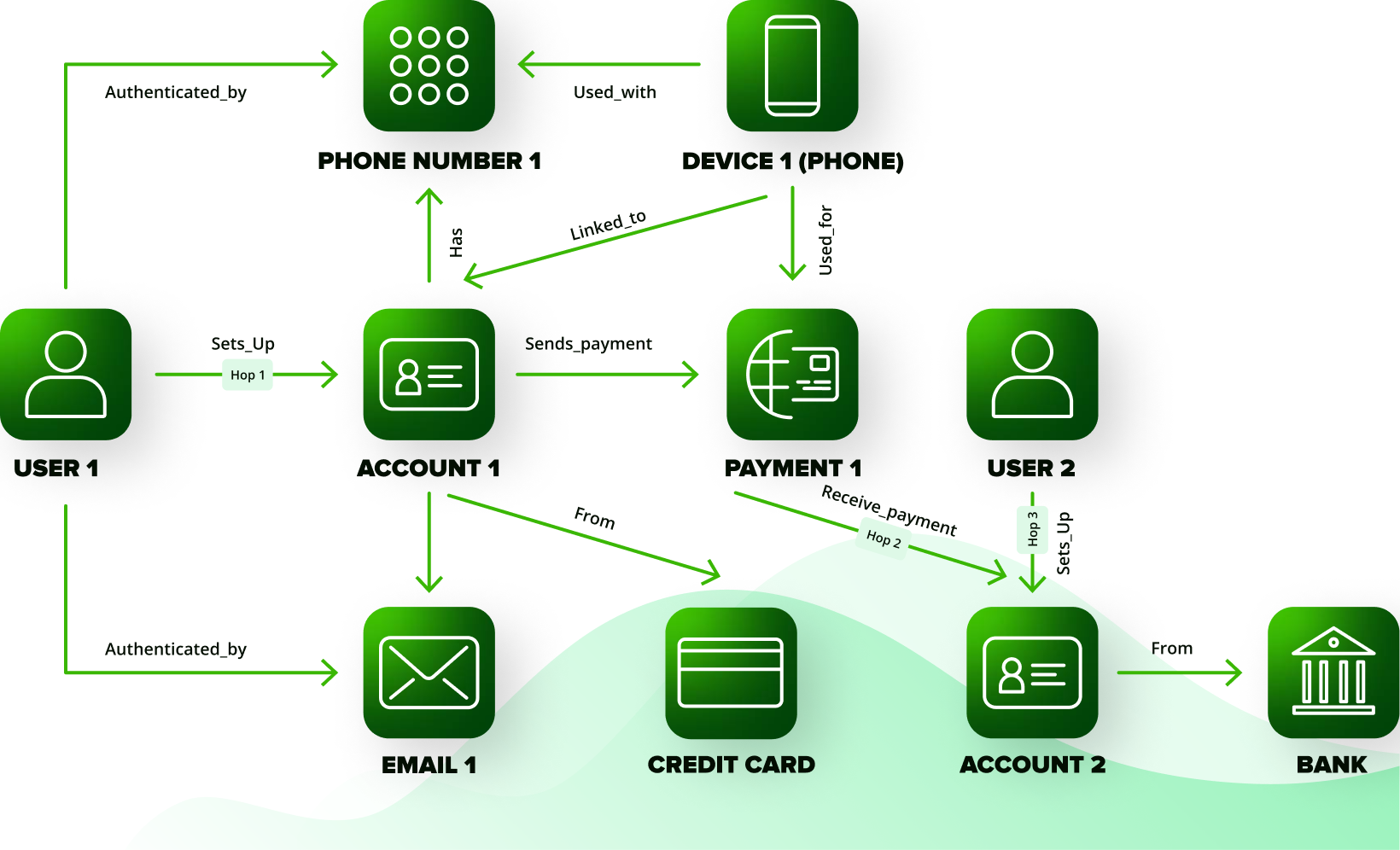

Graph analytics

In the context of financial fraud detection, graph analytics use a graph-based structure where entities (customers, accounts, transactions) are represented as nodes, and the relationships between these are represented as edges. If one individual (node) transfers money to another individual, that transaction can be represented as an edge connecting the two nodes.

This gives banks an advantage to uncover complex fraud schemes as graph analytics helps to identify sophisticated patterns of fraudulent activity, such as fraud rings, which may be missed by traditional detection methods. A fraud ring can involve multiple related transactions and accounts that are not easily noticeable when looking at individual transactions.

Comprehensive picture

Real-time detection is significantly enhanced as graph databases can process data in real time, which significantly reduces the time to react to potential fraud. It is scalable to handle large amounts of data, making it ideal for large financial institutions. It also provides a contextual understanding, where graph analytics not only analyzes individual data points, but the relationships and interactions between them offer a comprehensive picture of the data.

There can be challenges as graph analytics are more complicated to implement than traditional data analysis techniques, which can require specialized skills and training. While graph analytics can be highly effective in uncovering fraudulent activities, they may lead to an increase in false positives if not properly tuned, causing unnecessary investigation of legitimate transactions.

The computational requirements for graph analytics can be high due to the large datasets involved, requiring more powerful hardware and efficient algorithms to process. Graph analytics rely heavily on the quality of the input data which, if not accurate or comprehensive, can deliver unreliable results. But these can be mitigated with the right preparation and implementation. Graph analytics will enable banks to better explore and analyze network structures using searches, queries, and graph algorithms.

Keys to using graph analytics

| Graph Search and Queries | Graph Feature Engineering | Graph Neural Networks |

| Connected data in a graph database enables the first step to search the graph and query it to explore the relationships. | Data scientists use graph algorithms and queries to find features that are most predictive of fraud to strengthen ML models. | Offer a solution by representing local structural and feature context natively within the fraud detection deep learning model. |

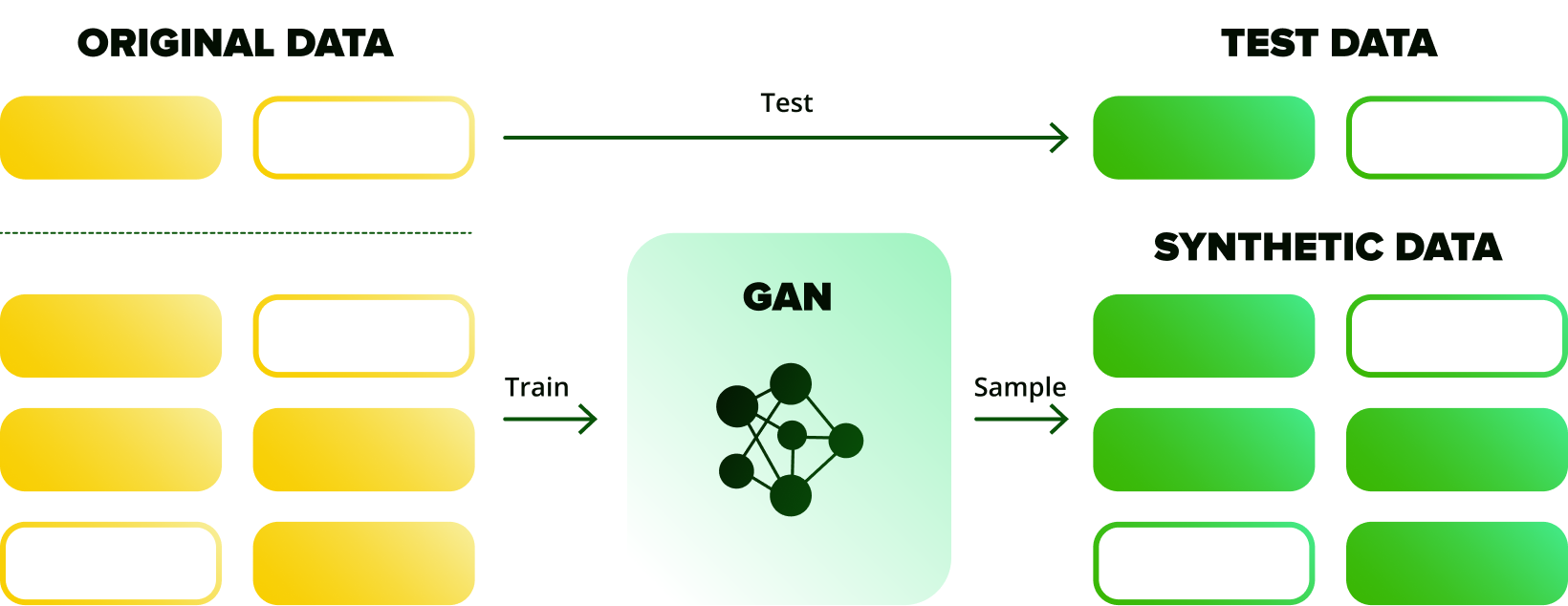

Synthetic data generation

Banks can use synthetic data in place of real data for added protection. They can also use it in addition to the real data as an enhancement to provide complementary analysis. This helps pilot new products, predict rare events, and assist in scenario planning.

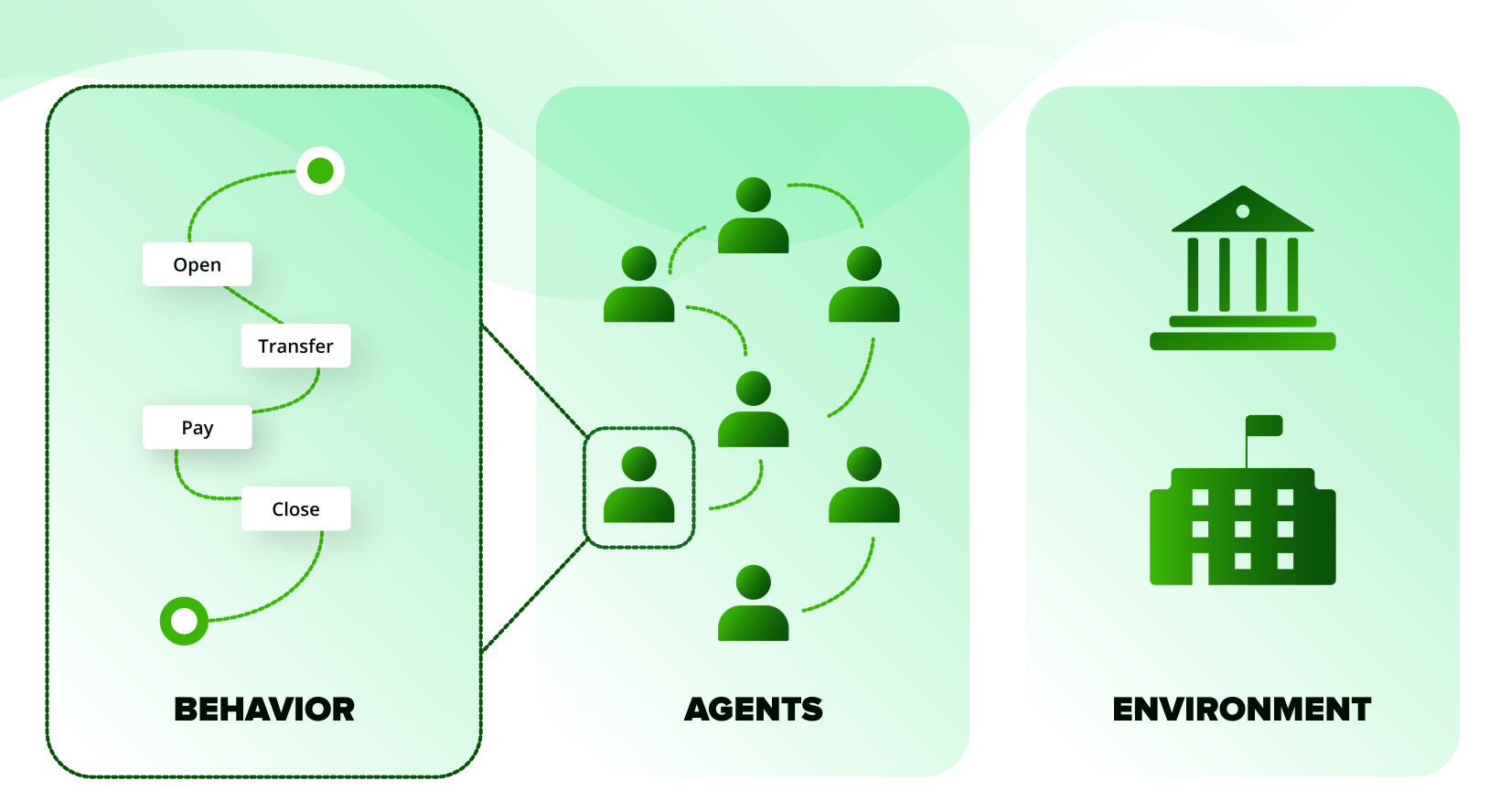

One of the most used methods for generating financial data is an agent-based computational model that can simulate the actions and interactions of individuals and organizations in complex and realistic environments.

Otherwise, an ML-based approach can generate data and preserve the original data’s statistical features while producing entirely new and private data points.

Summary benefits

The main advantage of deploying AI and neural network analysis is the ability for banks to enable real-time detection. The best AI processes incoming data and blocks new threats in milliseconds. It provides excellent security both because of its dynamic behavior and its speed.

It also grows better over time as the more data it has, the better its predictions. AI only ever improves over time, particularly where AI can share knowledge with others. For example, when a DataDome AI detects a new threat pattern, it will share it with other DataDome AI instances globally.

It means that a bank spends less time being reactive. Employees spend less time investigating threats and reviewing information because the AI handles that. This leaves them more time for projects that will create competitive advantages and grow the business.

Finally, the deployment of AI, graph analytics, and neural networks will give greater confidence to banks, their customers, counterparties, and regulators. It will ensure that the maximum is being done to secure transactions and other sensitive data in the face of a growing onslaught of financial fraud.