Last decade was one of the highest-returning and lowest-risk decades for U.S. stocks for the last 100 years. Investors’ confidence was building in taking on increased risk for a chance of higher returns. However, 2018’s equity market volatility was a reminder that this economic cycle has come to an end and this type of dynamic is here to stay.

New trends shake the business world and many market participants have felt unprepared. Investors are anticipating now more than ever the next market shock.

To exacerbate this anxiety, knowing that in this data driven world every bit and byte could produce a new insight or affect a whole new decision process, putting additional pressure on investors. Those who not able to read the data and lag in its processing will fall far behind. It’s time to face the fact that the volume of insights that data is able to provide is not manageable by any individual–a solo investor or even a portfolio manager.

Business Challenge

Portfolio managers and individual investors place particular focus on identifying areas of extra risk in investment portfolios. This is a challenging task and quite often having a deep understanding of business and profound experience are not enough.

The shock testing simulation technique is a core tool and critical element of risk management not only in the banking industry but also in investment portfolio management.

With the advances in data science and artificial intelligence (AI), shock testing software helps portfolio managers minimize risk and increase return on investments.

Project Description

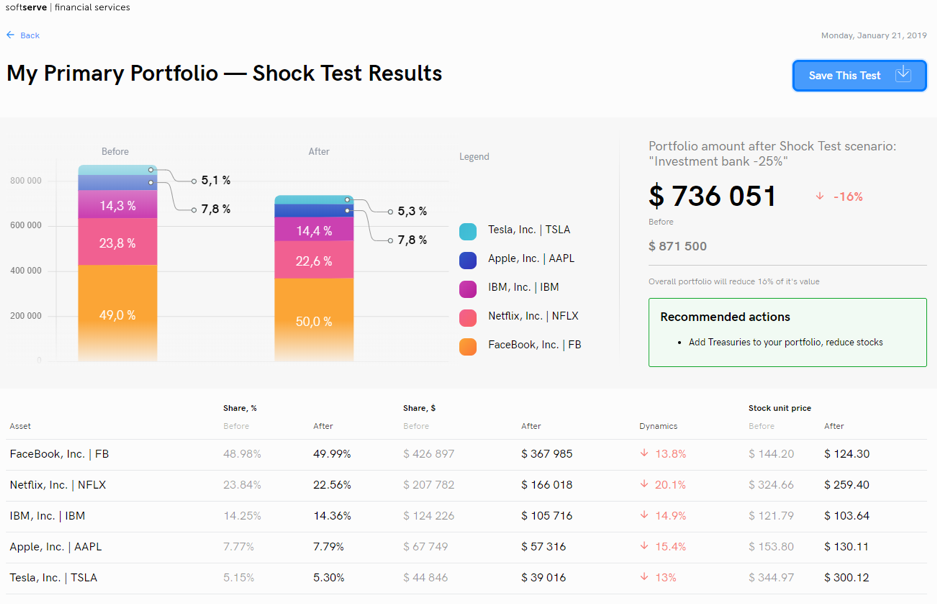

SoftServe’s Financial Services Lab, in partnership with its R&D department, developed an application that predicts the impact of extreme but plausible market changes on investment portfolios and enables portfolio managers to make adjustments to achieve higher investment returns.

SoftServe's Robust Shock Testing Accelerator harnesses the power of data science to simulate a portfolio’s reaction to design shock scenarios of various market conditions. The product analytics component provides insights into portfolio performance at a given time and also captures its dynamics.

The tool provides the following functionalities:

- supports historical portfolio tracking

- a range of shock scenarios

- sensitivity analysis and portfolio result of each shock factor

- recommendation for portfolio optimization for each predefined scenario

The Robust Shock Testing Accelerator not only answers the question “what comes next”, but also provides direction regarding how to act upon this information.

SoftServe developed the Robust Shock Testing Accelerator based on the Capital Asset Pricing Model, assessing the covariations between beta coefficients of portfolio stocks and a selected stress factor. Data extraction has been achieved through the application of a machine learning approach for a selected period. Observed dependencies of the factor and portfolio variables have been filtered using two approaches: quantile regression-based and weighted regression-based.

By applying these approaches, extreme values of the shock factor have the highest impact for the beta-coefficient assessment. Thus, stock behaviors are not biased by non-shock factor changes.

The investment recommendation functionality is delivered through the identification of investment instruments that can complement each portfolio to balance and optimize overall profitability in a given scenario. This has been achieved through a combination of Bayesian optimization and a Monte Carlo approach.

Business Value

With SoftServe's Robust Shock Testing Accelerator, institutional, angel, and individual private investors are now able to:

- run shock tests against scenarios that are tailored to suit specific portfolios

- identify the impact of projected scenario on portfolio structure, risk, and profitability

- optimize investment portfolios for each shock scenario

- stay on top of every portfolio's analytics in real-time