Don't want to miss a thing?

Credit Risk: Assess Probability of Default (PD) with an Application Scorecard

Credit risk management has evolved. Rapidly changing environments, stricter regulations, and emerging technologies demand faster, smarter strategies.

APPLICATION SCORING

An application scorecard analyzes a client’s creditworthiness using statistical models. It evaluates applicant and loan details, serving as a foundation for credit risk strategies in retail lending. At its core, the scorecard ties directly to the Probability of Default (PD), a critical metric for regulatory reporting and banking capital adequacy, as laid out in Basel II and Basel III. A higher score indicates a lower PD.

APPLICATION SCORECARD

| Characteristics | Attribute | Score |

| Credit History | Good | 51 |

|---|---|---|

| Bad | 0 | |

| N/A | 15 | |

| Loan amount | 100..1500 | 81 |

| 1500..2300 | 49 | |

| 2300..3500 | 41 | |

| 3500..8000 | 23 | |

| 8000+ | 0 | |

| Number of dependents | 0..0 | 0 |

| 1..2 | 25 | |

| 3+ | 12 | |

| Age | 18..24 | 0 |

| 25..29 | 22 | |

| 30..39 | 33 | |

| 40..55 | 39 | |

| 55+ | 47 | |

| Income (monthly) | 0..550 | 0 |

| 550..1300 | 10 | |

| 1300..2800 | 22 | |

| 2800..4500 | 48 | |

| 4500..8000 | 67 | |

| 8000+ | 62 |

To calculate a customer’s score, add the points linked to their application’s characteristics. Building a scorecard takes time, but it’s simple to deploy, integrate, and use. You might ask, why invest in building one? Let’s break down the benefits.

KEY BENEFITS OF USING A CREDIT RISK SCORECARD

The first benefit of a scorecard is reducing delinquency rates. A well-designed credit risk scorecard clearly separates good users from bad ones.

The second advantage lies in better risk assessment. With a scorecard, you can predict cash flow or profit and loss (P&L) and allocate funds appropriately based on portfolio risk.

Another big benefit is faster application processing. Scorecards deliver results in minutes instead of hours or days.

Scorecards also support risk-based pricing. Low-risk customers get better rates, while high-risk ones face higher charges.

Other benefits include meeting regulatory standards and detecting internal fraud. Scorecards help you gain deeper insights into your customers while keeping tabs on suspicious activities.

BUILDING THE SCORECARD

Wondering how to create an application scorecard? Here’s a step-by-step guide to get you started.

Step 1: Gather and prepare data

Begin by assuming that your customer’s behavior will reflect historical patterns. This lets you predict their creditworthiness based on trends from previous loans. Collect historical loan data, validate its quality, and ensure you have enough records (at least 2,000) to build a stable scorecard.

Next, clean the data. This includes detecting anomalies, filling in missing values, and addressing inconsistencies. If possible, collect credit bureau data and consider using social media data as a complementary source. Tools like SAS, R, SPSS, or Python will help you analyze data extracted from databases like SQL.

Step 2: Define defaults

Choose an observation period and clearly define what constitutes a "default" or "bad" debt. Typically, payments delayed by 60 to 90 days are treated as defaults. This reframes the task into a simple binary classification problem to predict if a customer will repay their loan.

Step 3: Analyze data

Conduct detailed data analysis. Categorize continuous variables, check correlations, filter data, and segment it as needed. Split your dataset into training, validation, and testing subsets for accurate predictive modeling. This step is crucial for building a reliable scorecard.

Step 4: Build the model

Develop your model, often using logistic regression. Sometimes decision trees are used, but Artificial Neural Networks are rare due to their complexity and lack of transparency. Once you’ve built the model, assess it thoroughly. Use tools like the Gini coefficient, ROC curves, and confusion matrices to evaluate accuracy and stability. This step also includes model selection and fine-tuning.

Step 5: Predict and create the scorecard

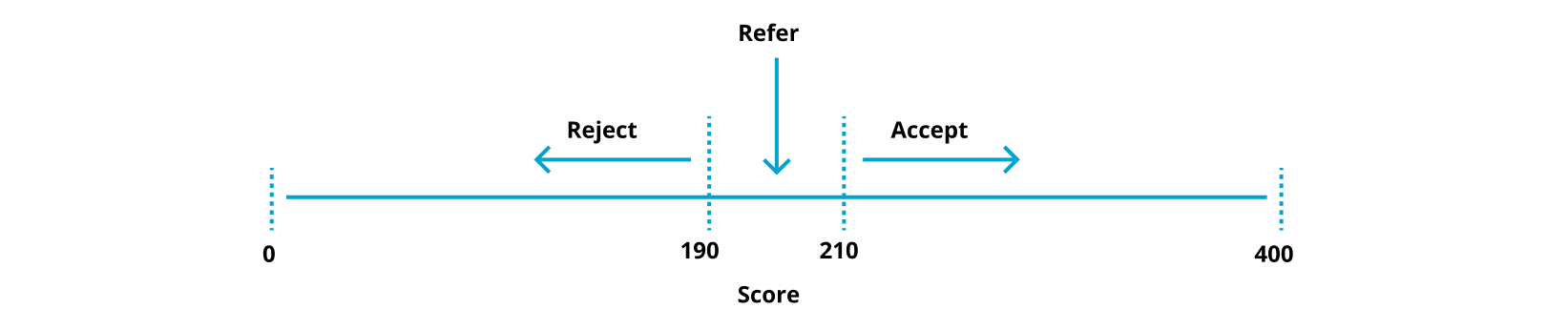

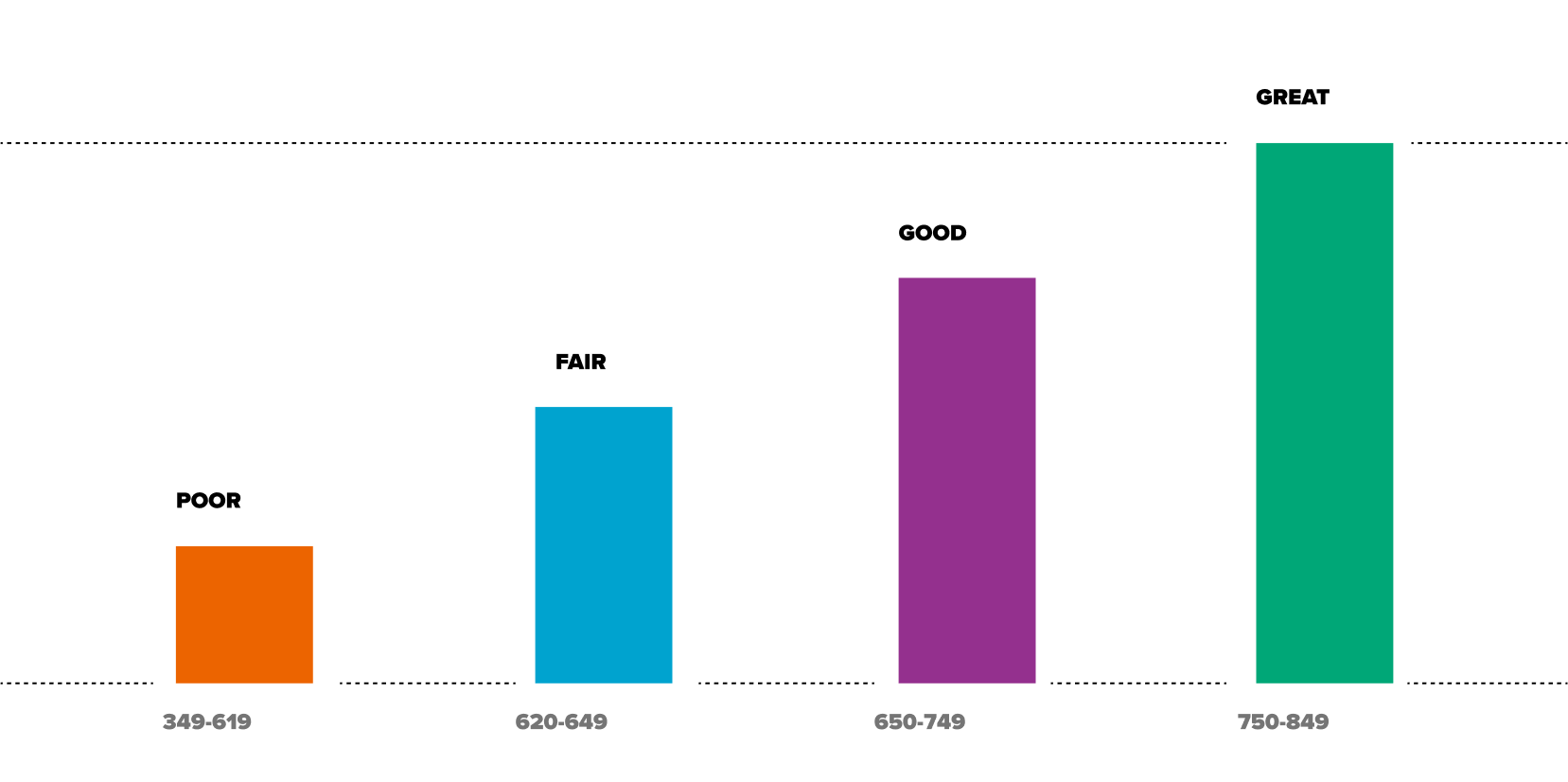

With your model ready, you can calculate the Probability of Default (PD). Transform the PD into a score using your chosen scale. At this stage, you’ll also create risk categories and set cut-off points. You might even include high-level policies as part of your credit risk management framework, aligning credit strategies with your business goals.

FINALIZATION

We’ve covered the definition of an application scorecard, the motivation behind its use, and the key steps in the scorecard development process. Next, think about how it fits into your broader strategy.

Where does your credit score fall?

A well-designed scorecard works as part of your broader credit strategy and process, not as a standalone product. To keep it effective, set up a monitoring framework and alert system.

Make sure to evaluate its performance regularly, at least every quarter. Use these evaluations to decide if you need adjustments or a full model rebuild.

We’ve outlined how to build an application scorecard, covering every step — from gathering historical data to modeling and ongoing monitoring.

At SoftServe, we combine a solid engineering foundation, expertise in building efficient, distributed systems, and a team of skilled analysts and subject matter experts. This allows us to solve your business challenges with precision.

Start a conversation with us