Don't want to miss a thing?

Customers expect personalized experiences, real-time transactions, and seamless access across multiple devices. Meeting these expectations pushes banks to adopt new business models and invest in technology that keeps them connected to their customers.

Yet many innovation projects fail before they even launch, often due to siloed communication, a lack of shared vision, misaligned stakeholders, or poor planning. To succeed, banks first need to identify their innovation priorities based on key pain points and strategic goals. From there, they can move on to ideation, collaboration, iteration, and ultimately, bringing ideas to market.

In this article, we’ll explore the different types of innovation, best practices for planning and ideation, and how banks can successfully turn ideas into results.

FOUR TYPES OF INNOVATION IN BANKING

Innovation in banking can take different shapes depending on whether it focuses on technology, business models, or both.

Incremental innovation

The most common type. Uses technology to improve customer value through new features, design changes, or efficiency within the existing business model.

Example: Chase Bank introduced self-serve teller kiosks, allowing customers to complete transactions without waiting for a bank employee.

Disruptive innovation

Applies new technologies or processes while keeping the business model intact.

Example: Apple Pay on the Apple Watch allows instant, mobile payments.

Architectural innovation

Combines technology shifts with changes in the business model.

Example: Habito lets customers apply for a mortgage and get a decision in minutes online, before visiting a branch to finalize documents.

Radical innovation

The most transformative. Introduces revolutionary technologies that create entirely new trends.

Example: Blockchain technology replacing traditional fraud prevention systems.

Banks should weigh these types against their readiness for change and available resources. Many start with incremental innovation because it causes less disruption. FinTechs, however, often leap straight to radical innovation, targeting progressive markets. BBVA, for instance, focuses on incremental improvements, making its products simpler and more consistent across all channels.

FROM VISION TO EXECUTION: STRUCTURING CHANGE

Innovation requires a clear plan that sets direction while leaving room for flexibility. A solid framework should include:

- Stakeholders and roles

- Resources and systems

- Milestones and timelines

- Contingency protocols

Documenting this framework helps prevent budget cuts or leadership changes from derailing the project. While not every detail must be fixed from the start, the foundation ensures teams can adapt as new issues arise.

Executives also need to track objectives, define the right audience, and measure progress throughout the project. Gathering feedback from customers, consultants, and external advisors can reveal blind spots missed internally.

HOW BANKS CAN GENERATE BETTER IDEAS

Barriers such as siloed departments and misalignment with customer needs often block innovation. The ideation process tackles these challenges through a customer-focused methodology and collaboration.

Empathy through design thinking

Understanding customer pain points requires stepping into their shoes. Design-thinking principles help banks identify struggles, uncover “why” behind them, and build solutions that genuinely improve experiences.

Example: UK challenger bank Monzo grew rapidly by adopting a customer-centric approach. Features like instant transaction categorization and real-time spend advice were developed directly from customer feedback.

Collaboration with transparency

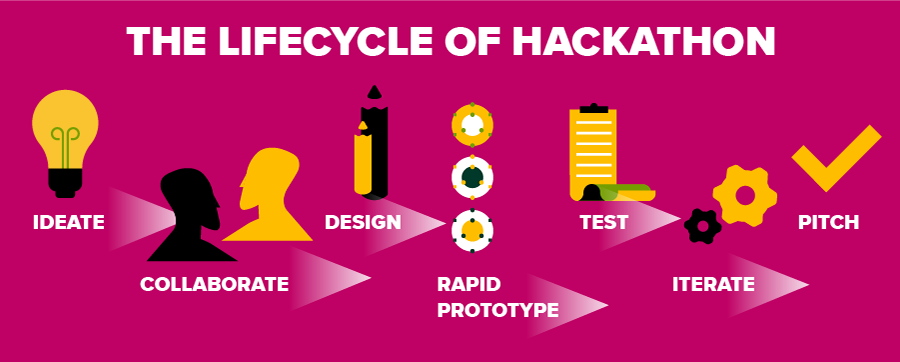

The best ideas often emerge when individual input is combined with group collaboration. Hackathons are a powerful way for banks to accelerate innovation. These moderated, multi-day events bring together developers, business leaders, and specialists from different fields to solve real customer challenges in a focused, collaborative setting.

A typical hackathon follows three stages:

- Preparation – The bank’s innovation team sets clear requirements, objectives, and constraints. Facilitators are assigned to guide each team.

- Creation – Teams brainstorm around customer pain points, design solutions, and build prototypes. Subject matter experts (SMEs) act as mentors, offering technical and strategic guidance. The environment encourages openness, trust, and rapid problem-solving.

- Testing & Pitching – Prototypes are tested, refined, and then presented to a judging panel. Winning ideas may proceed to full development.

The goal isn’t just to design new products, but to challenge existing processes and spark creative thinking.

Examples of outcomes:

- Blocknify, a blockchain-based contract signing tool, emerged from a hackathon.

- Outside banking, hackathons gave birth to Facebook’s “Like” button and Dropbox.

- At SoftServe, a hackathon for Amplify explored how Amazon’s Alexa could enrich an educational product.

Hackathons allow banks to break through routine, generate fresh ideas under real-world constraints, and keep an innovative spirit alive across the organization.

THE POWER OF AGILE ITERATION

Once an idea is selected, progress depends on adopting an agile, fail-fast approach. Working in iterations lets banks test proof of concepts (PoCs), collect feedback, and refine designs before costly implementation.

This approach ensures:

- Early detection of flaws before scaling

- Transparent feedback loops for stakeholders

- Reduced risk of overspending

Without structure and expertise, innovation projects are hard to monitor and prone to failure. A detailed plan with clear roles and tracking mechanisms supports efficient execution.

DELIVERING INNOVATION AT SCALE

The final step is turning prototypes into a validated Minimum Viable Product (MVP). Setting clear objectives and key results (OKRs) ensures expectations are aligned before scaling. MVPs help determine which features customers value and which they don’t while testing market demand.

After launch, continuous ROI tracking guides further improvements. With a well-executed implementation plan, banks can accelerate outcomes and deliver compelling experiences to customers.

CONCLUSION

Innovation in banking is not a one-time effort but an evolving strategy. By understanding different types of innovation, planning carefully, fostering customer-centric ideation, iterating quickly, and scaling effectively, banks can transform how they serve customers.

With the right platform and expertise, banks can move swiftly from ideation and prototyping to user feedback and commercialization, creating meaningful experiences that drive long-term success.

Ready to innovate? Let’s get in touch to bring your next digital banking solution to life.

Start a conversation with us