Don't want to miss a thing?

Digital Asset Custody Solutions

Technologies globally reinvent money. The financial industry evolves with new types of assets that are unclear to the end, but with clear expectations of faster, cheaper, and inclusive financial services. Cryptocurrencies is the most popular category of digital assets. Large financial institutions seeking new value in asset management and investment banking have already launched initiatives with technology providers, developing solutions beyond cryptocurrencies. Digital assets issued and transferred using distributed general ledger or blockchain represent new opportunities for financial operators and technology providers.

Custodians – Keep the Core, Onboard the New

Digital assets trading and management require a solution to ensure safety and customer protection. This means that digital assets custody must meet the expectations of institutional and individual investors.

Large asset managers, banks, exchanges, and other financial services providers are seeking technologies that offer the ability to store, buy, and sell digital assets that are fully compliant with the requirements investors are used to using for services from regulated incumbents.

Technology options allow providers to protect their customer’s funds through managing private keys and robust authentication procedures.

Custodian services for digital assets require specific technological solutions that combine the security inherent to qualified custodians with the speed and flexibility offered by leading financial service providers. Regulations for digital asset service operators remain in development, representing the chief headache for technology providers.

What is Digital Asset Custody?

Digital Assets Custody includes the storage and protection of digital assets on behalf of their owners.

Traditional custodians provide data related to customer’s daily buy-and-sell of traditional assets and integrate them overnight with market data providers and additional processing data. For digital assets, these processes are real-time and require other integrations with the fund providers and simultaneous processing of positions for further decision-making.

Large banks begin their initiatives with cryptocurrency but are seeking the technology beyond cryptocurrencies.

Cryptocurrencies are created and transferred between owners using cryptography and a decentralized network. In some cases, the solution includes cold storage for better protection from unauthorized online access to customers’ private keys.

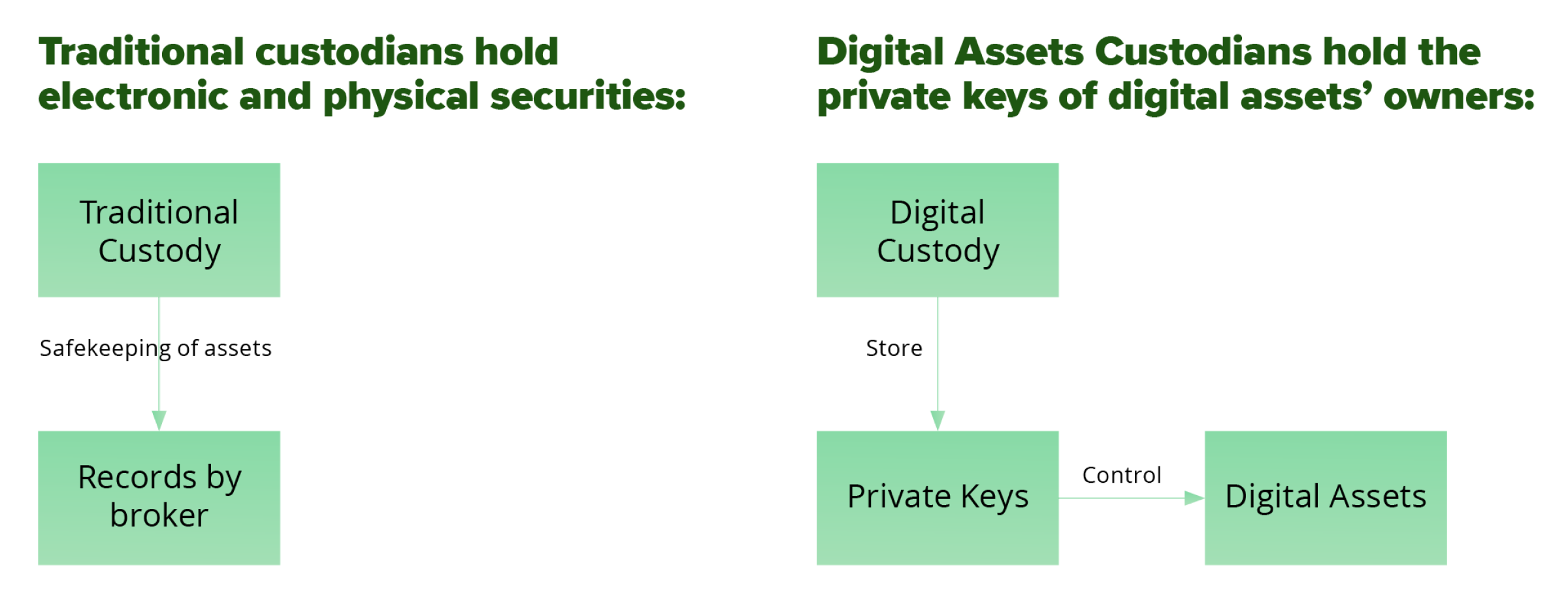

Compared to traditional custodians, decentralized ledger allows the elimination of intermediary processes. Transactions on blockchain replace the recordkeeping used by traditional custodians, so instead of physical or electronic storage of securities, digital asset custodians store the cryptographic private keys of digital assets owners.

Digital assets custody services are part of decentralized finance ecosystem .

Custody services are direct when the financial institution manages digital assets themselves, and sub-custodian when the financial technology provider processes custody services of digital assets on its platform.

The type of custodial activity defines the cost of development, ability to scale, and control over the new revenue streams.

Our clients ask us which solution will best secure the client’s assets.

We consider the client’s needs, functions, and operating model, and then the regulatory requirements where they operate. In addition, we begin with an architecture vision that considers the client’s existing systems strategic plans and future business needs.

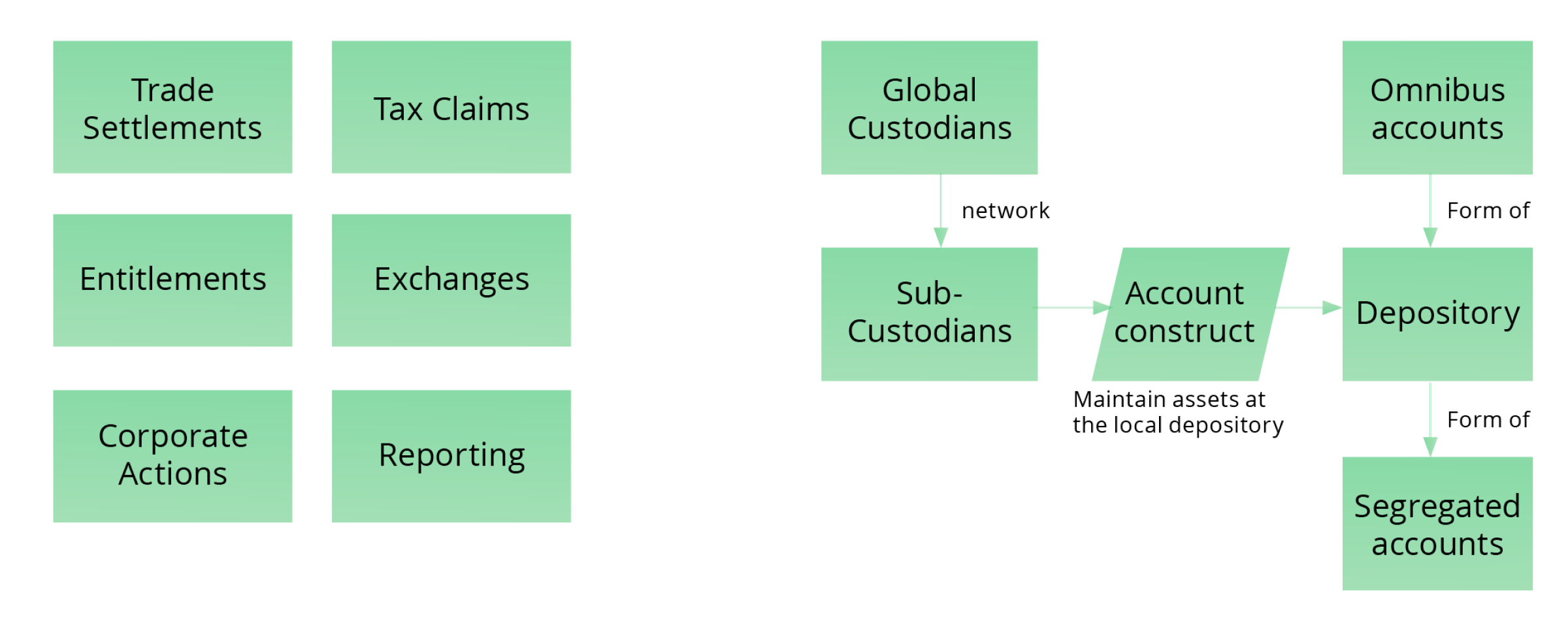

| Traditional back-office functions with technologies acquire new meanings | Technological solutions developed to fit custodian needs and regulatory requirements |

DACS Solution Options – no one size fits all solutions

Custody technology and asset servicing offerings include these options:

- Wallets: hot, cold, warm, and multi-signature

- Digital keys management for institutional digital assets space and individuals

- Smart contract-enabled securities

- Fund administration, audit, tax services, and other custodian services.

A Wallet lies at the core of digital asset custody, and is used for secure cryptographic keys storage.

Two types of cryptographic keys represent the ownership of digital assets:

| A public key | A private key |

|---|---|

| A public key can be considered the bank account and its representative address on the blockchain as an account number. |

TA private key is like a PIN code, similar to a bank debit card used to access a bank account. It is used only by the owner and is never shared with third parties. It proves ownership and authorizes transactions with a digital signature. Private keys are stored in the wallets, which can be in three forms–cold, hot, and warm. Wallets can be as part of hardware known as Hardware Security Modules (HSM), software, or written on a piece of paper. Regulators are very concerned about the storage and management of the private key, as ownership of the private key defines the ownership of client’s assets. |

In addition to wallets, there are several other options to store and secure private keys. Owners can store crypto assets in a wallet as a single crypto asset or multiple assets. The key management solution also has several implementation options. Custodians can manage keys on behalf of their owners, always involve the owner in key management, or combine both. Should owners lose the password for shared permissions, a custodian can send a verification message and provide access to the assets once verified.

To achieve regulatory compliance, digital asset exchanges need to satisfy many open questions, which clearly must be included in the Software Development Life Cycle (SDLC). In addition, fintech companies small and medium-sized banks, and also payment providers, are now offering retail customers the ability to buy and sell cryptocurrencies. The clarity in government regulation will encourage these capital market participants to apply all of the new, emerging requirements to be fully compliant.

Large banks and technology leaders include developing digital asset services as a business segment strategy. In recent years, the volume of trading in cryptocurrencies and initiatives with crypto-based technologies has left no doubt regarding decentralized ledger technology.

Nevertheless, regulators remain cautious and cause financial institutions to be careful not to damage the trust in regulated financial markets that operate with huge volumes of their customers’ assets. Starting small and applying crypto-based technologies for new forms of money is the right path to take.

SoftServe’s experience shows that even such small initiatives can be essential for a bank or digital platform provider’s business transformation. Digital transformation usually takes time to adapt inside-out to identify the organization’s processes and dependencies within related business lines and project teams to avoid change management risks.