IoT and the Possibilities for Smart Insurance Platforms

Billions of smart devices and sensors in cars, homes, and other environments are generating disruption in the insurance industry. But rapidly changing lifestyles and developments in connected devices provide a great opportunity for insurers. They get the chance to expand use of their digital layer of telematics and broaden the integration of telecommunication and information processing within all connected devices and sensors.

The issue at hand is monetizing IoT infrastructure from an insurance stand point.

This change will lead to a new version of personal insurance. Expansion of digital insurance models through connected devices and platforms will create useful analytics for insurers. They will have the ability to better understand thei r customer personas and to engage more closely with them. Thus, the following benefits will appear:

- Connected sensors inside cars, homes or infrastructure objects will allow insurers to track and immediately identify potential risk user profiles to simultaneously create individual risk profiles and personalized products.

- In addition, underwriters will have the ability to participate in managing clients’ risk by interacting with them more frequently. They will be able to take active part in risk management through their customers’ connected devices—like health tracking, for example.

- Furthermore, insurers will get the chance to leverage individualized data gathered through connected devices. This allows them to gain a better view of customer personas, identify their lifestyles, and work with external parties to deliver relevant and financially beneficial insurance offers to clients.

Key Challenges

To reap all the benefits of a new business model enabled by connected devices, the insurance industry must work closely with the digital service providers that will leverage them. These are software and hardware layers integrated into one eco-system. Insurers should also define the acceptable boundaries of utilizing customer data based on data regulations across the globe.

Business Model with a Digital Layer

Traditionally, prices for insurance policies are created based on statistical models and predictions made on the available information.

- Risks are priced based on the data provided by customers, along with 3rd party information (including historical data and predictive analytics).

- After binding, insurers do not interact with their customers until renewal or in the case of specific events, such as insurance claims or servicing (e.g. user information change).

- Only during the next renewal cycle are custome r achievements and losses updated in their risk profile.

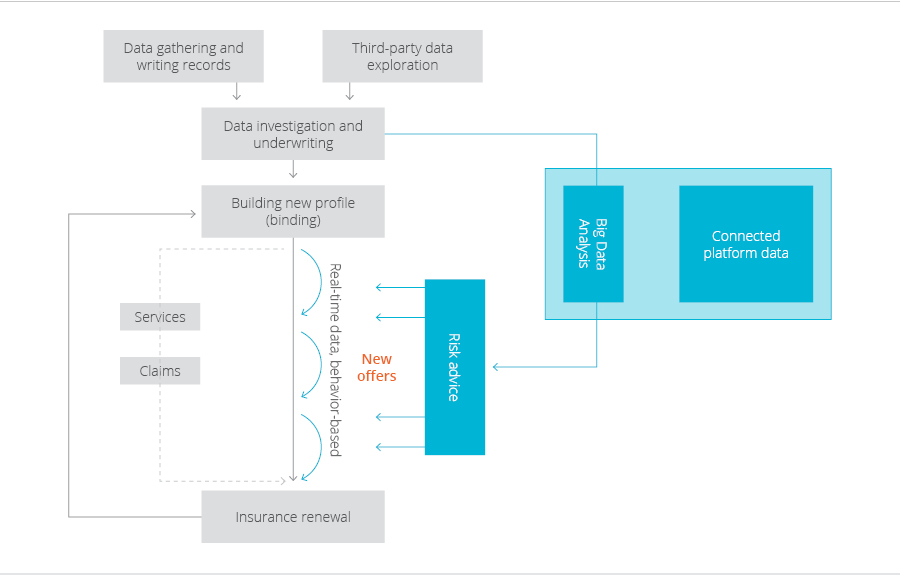

See the below graphic for an example of the digitally connected model. Gray represents the traditional structure, and blue represents the digital extension using connected devices:

In the mid-2010s, there was an initial attempt to introduce insurance products based on the technology. It enabled insurers to track customers’ trips and to customize products for them. The next generation produced wireless communications that enabled auto insurers to collect more data and to understand the behavior of their customers in real time or near-real time. Leveraging that data enabled undertakers to charge customer premiums based on their usage of vehicles and driving behaviors, rather than suggesting a typically fixed price per day for the insurance product. In addition, it provides a strong correlation between vehicle usage and risk, such as in the case of an Uber driver. That’s why modern tracking devices have evolved to measure more and more additional behavioral factors: from rapid acceleration to air bag deployment, from pulse to emotional conditions.

Key Benefits of a Digital Layer

Pricing Accuracy

Real-time risk tracking models will become more accurate as the individual approach for each customer and near real-time data are used together with historical predictions based on segmentation and AI algorithms.

Fewer Claims

Products connecter with IoT will stimulate safer customer behaviors as insurance products are directly linked to existing behaviors and real user data. This will reduce the overall number of claims for insurers.

Personalization

Insurance products will become completely personalized to e ach customer because of the usage of all connected devices and user data. This will result in cheaper insurance products and will increase customer loyalty to insurance companies.

Transparency

As customers’ usage and behaviors become more measurable, insurance companies will gain better visibility of the data. This is the root for claims, thus the opportunity for fraud will constantly decrease.

Engagement

Insurers will be able to access additional channels to engage with new customers through mobile and newly developed “connected platforms.” Also, big data will help to generate more relevant offers for the lead customers.

People may be asking themselves: “Is this the future?” No—this is happening right now!

The better question is: “Who will be the first trailblazers to build a smart insurance platform?”

Within our BFSI lab, we are actively working with multiple customers to build different blocks of new-generation platforms. And in the near future, it will be integrated into one.

Click here to contact us and learn more about building your own smart insurance platform.