download pdf

And it’s not that surprising. Look at recent innovations across a myriad of retail financial institutions – today, most banks offer consumers the ability to deposit checks directly from their smart phones, going well beyond what was once considered “internet banking” defined just five years ago.

But while these customer experiences appear seamless on the surface, there’s quite a lot of heavy lifting in the background. In order to deliver these and other digital solutions, tailor-made application programming interfaces – or APIs – are needed.

Over the past few years the rise of an economy driven by APIs has pushed those in the financial services industry to evolve into digitally-focused companies. But doing so requires deep tech know-how, and a collaborative approach.

But what is an API?

APIs determine how software programs interact, making them imperative for streamlined processes. APIs are also used for creating user interfaces, making them the foundation of how your business interacts with users. As a result, APIs need to be driven by customer needs, and require a thorough understanding of what those needs are in order to be effective.

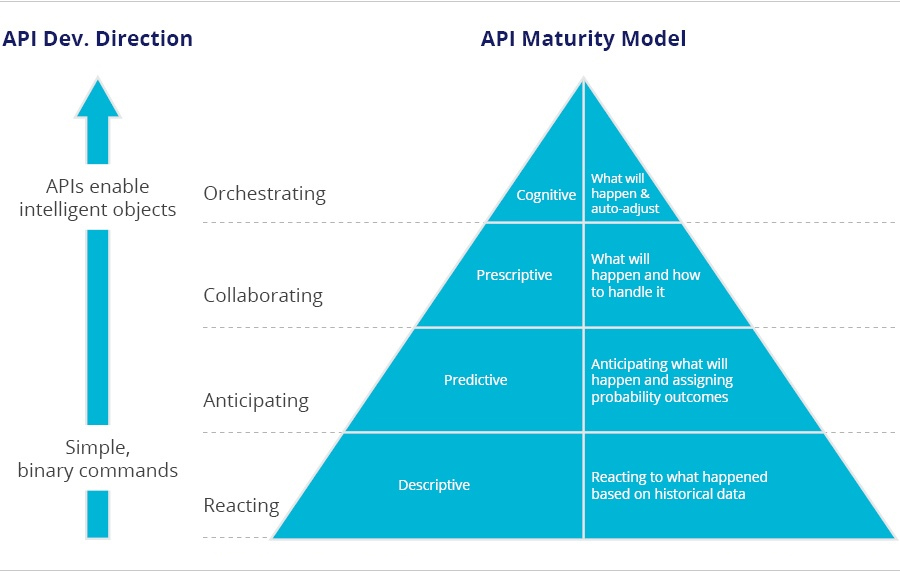

According to Forbes, “customer-centric APIs are driving greater maturity into development cycles, enabling quicker maturity of API code bases across the board.” The higher the level of detail and the more intelligent the API, the better equipped it is to read and manage customer demands.

To meet the growing demands of your clients and partners, your business may find it imperative to grow your capabilities and services offerings as quickly as possible. One way to do this is through the adoption and utilization of out-of-the-box, external APIs from both public and private providers.

Or, depending on the nature of your problem and the complexities of your business, you may find it better to develop and expose your own APIs. This enables the access and visibility to your key systems that others need, and they’re tailor-made to your business and—more importantly—to your customers.

The outcome is clear: you’ll get an API that is better suited to your customers. But it’s not as simple as it sounds—building the right API requires deep technology experience with the right technology partner.

Find out more about the benefits of a unique API and how to create one within your company in our latest white paper, “Financial Services + Digital: How to Beat the Demand.”