Refocusing Traditional Due Diligence for Private Equity Firms

The need to forecast a deal’s success is critical for high-tech segment investments. In this blog series, SoftServe offers private equity firms a framework to reimagine traditional due diligence for potential target companies, their products, and portfolio companies.

How is due diligence different when investing in high-tech companies?

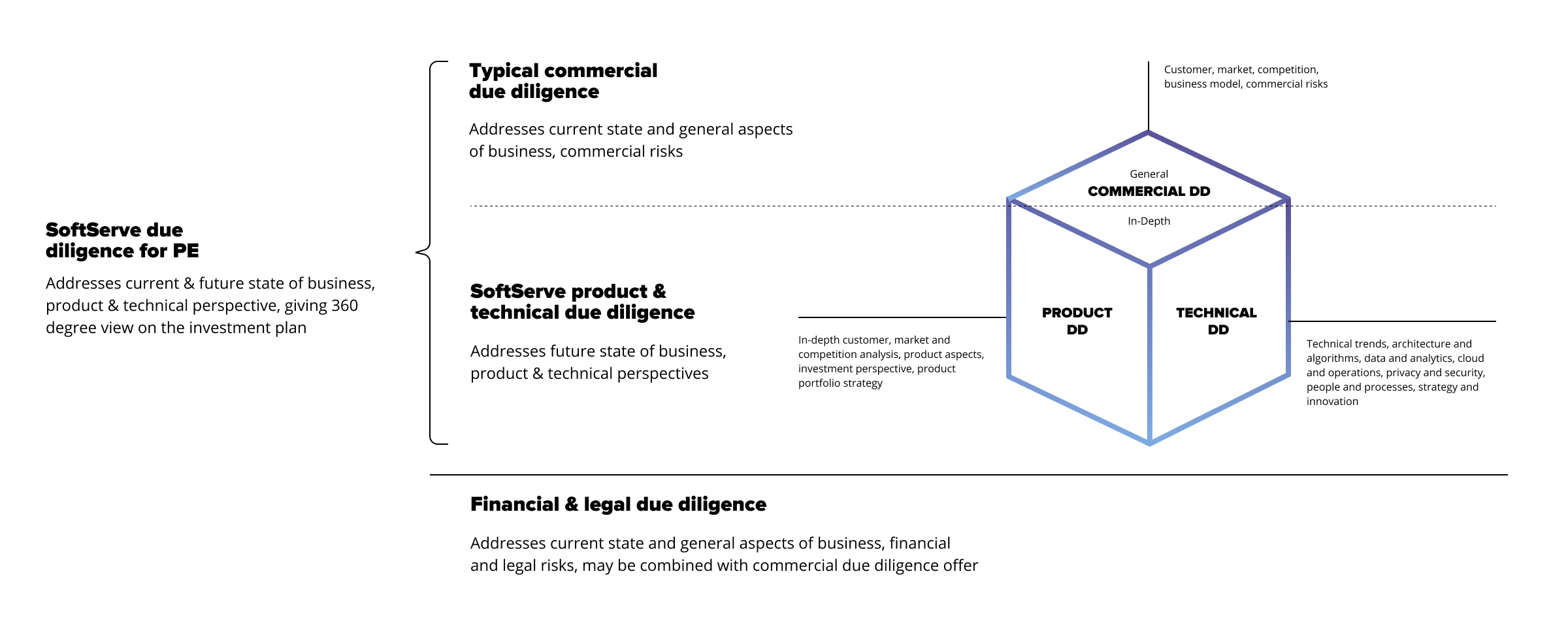

Traditional due diligence (DD) deals with the analysis of the target company’s finance, legal conformity, organizational structure, product and customer analysis, and more. When a PE (Private Equity) firm focuses on high-tech investments, it’s crucial to evaluate current and future product potential holistically. This means taking in the unique value proposition and business model, as well as the target company’s orientation on artificial intelligence and machine learning, big data, IoT, and other emerging technologies. The target company must have viable product offerings and solid expertise in digital innovations and intellectual property to sustain and accelerate its market growth in the long run.

An in-depth assessment of the target company’s digital maturity and growth potential will reveal the aspects that add to the investment’s success or highlight the ones that can lead to its decline. It covers aspects such as the organizational structure and culture, operations and processes, technology, market, strategy, product, and customers.

And this is what differentiates high-tech company due diligence assessment from traditional due diligence—focusing on sizing the future potential and evaluating the target company and its product readiness to support investment growth targets.

When conducting due diligence service for PE, consultants should investigate the target company both from the product and technical sides. Moreover, it is essential to perform a proper risk assessment covering data privacy and security, process maturity and discipline, and ongoing technical maintenance risks of the target’s intellectual property.

Here’s a comparison of traditional and PE due diligence.

Why conduct due diligence if you’re a PE?

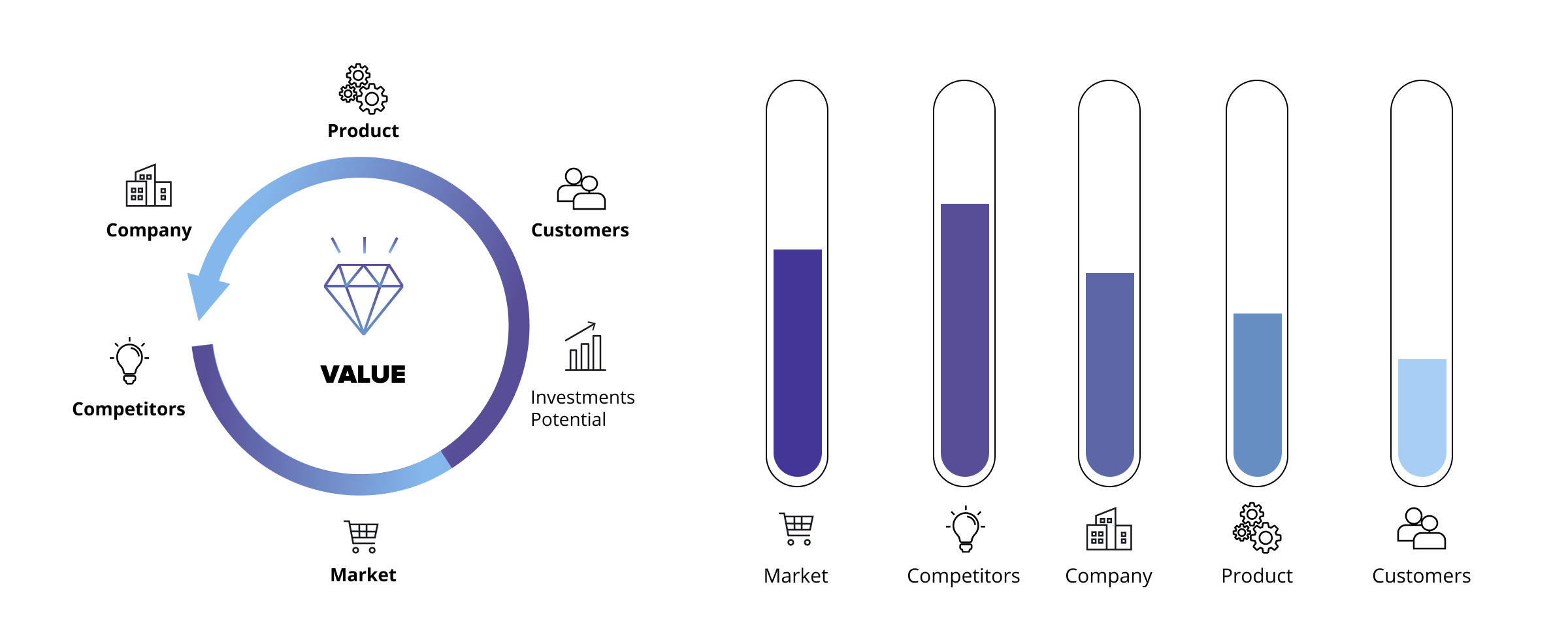

Due diligence addresses the critical challenge that an investment company encounters: lack of data-driven insights to support investment business cases. Private equity investors seldom have enough time to complete a substantive analysis of the target. Instead, they seek a trusted partner to carefully assess industry dynamics, examine business model stability, value creation opportunities, product strategy and innovation potential, exit strategies, and more.

This partnership benefits from powerful objectives:

- A process to collect, process, and get actionable data insights from the target company’s information to ensure the investment will be profitable and with minimal risks.

- Assistance with the analysis of business-related, product, commercial, and technical risks during the investment process.

- Confidence in avoiding overpaying by misjudging the target company or product’s capabilities.

A thorough DD process provides comprehensive approaches to these objectives and more, depending on the project specifics and PE clients’ needs. Acquisitions involve opportunities and risks, and it is important to know whether business projections can become a reality or are even attainable. Transparency around the target company’s organizational capabilities, processes, and product potential, is also needed.

How can SoftServe help?

SoftServe partners with PE firms to assess a target’s current state and recommend a sound product growth and technology strategy. The SoftServe DD team is comprised of senior and principal consultants who conduct:

- Analysis of the target’s background, market position, organizational structure, and management.

- Market insights analysis covering customer analysis, competitive landscape, and market trends.

- A comprehensive analysis of the business model and its sustainability.

- Evaluation of product’s current performance, product, and UX strategy assessment.

- Insight research into the target’s unique selling proposition.

- Assessment of target’s digital maturity and evaluation of its technology strategy.

SoftServe has developed a comprehensive assessment framework that helps investors investigate critical risk areas to understand the actual potential costs and growth potential of a transaction. Our due diligence service covers the following two categories:

Our product assessment has been developed based on our diverse experience successfully leading and managing digital products for our ISVs and global enterprise clients.Our technical assessment has been developed over years of expertise in assessing commercial and enterprise software products’ technical ownership.

The SoftServe DD service can be customized for each investment assessment based on specific investment goals and target company context.

Due diligence is a way for an investor to assess risk accurately. But for PE investment, the level of uncertainty is often higher, reflecting the nature of a product’s or a technology’s early stages or the business immaturity of a target company.

While analyzing the target’s current state, the SoftServe team will uncover the areas of information deficits that would most affect the investment decision. We study these areas and provide insight in a report that offers investment plan items, product strategy hints, and technology know-how recommendations.

This helps cover intelligence gaps and establishes a clearer picture of the investment opportunity. The focus here will be on the current and future state of the opportunity being evaluated. As such, a PE-oriented DD approach often may involve assessing the product fit into the investor’s portfolio, measuring the effect of the acquisition, and preparing product/market forecast scenarios and other valuable information that the investor is likely to request.

Learn more about SoftServe’s approach and experience with product and technical due diligence frameworks.

Let’s talk about how SoftServe can help you make confident investment decisions with our due diligence services.