Don't want to miss a thing?

Product Due Diligence: Reducing the Doubt About an Investment Decision

Private equity organizations risk making poor investment decisions if they skip expert evaluation of an acquisition target’s potential. This is especially true for software technology companies, where the stakes are high and the risks too costly to ignore.

Some warning signs include:

- The investment plan doesn’t align with the client’s goals.

- Products or company-wide operations show critical weaknesses.

- The target’s value proposition is unclear.

- There is no vision for future growth.

Due diligence also enables effective post-acquisition steps, such as cloud migration, modernization, and functional capability improvements. Its benefits far outweigh the investment. Thorough risk and expectation management comes not from generalizing but from separating analysis into product and technical due diligence. In the following sections, we’ll explore the product assessment framework and how it helps private equity firms achieve their objectives.

IT ALL STARTS WITH DATA

Identifying potential risks when investing in a product company or startup and shaping a post-investment, value-driven strategic roadmap are key factors in making sound decisions. However, trying to conduct a thorough evaluation or business analysis on your own can be daunting, especially when uncertainties about selecting the right investment target are high.

Some important questions to consider:

- What are the scenarios for the company’s revenue and capitalization?

- Does the company’s product meet domain-specific demands?

- What technical risks could reduce the product’s chances in the market?

- Are the target company’s insights grounded in reality?

For private equity investors drawn by the promise of high returns, remember that promises without data-driven evidence carry higher risks. Due diligence consulting services can help uncover red flags and provide a strategic post-acquisition roadmap, increasing the chances of investment success while optimizing internal efforts.

KEY ASPECTS OF PRODUCT DUE DILIGENCE

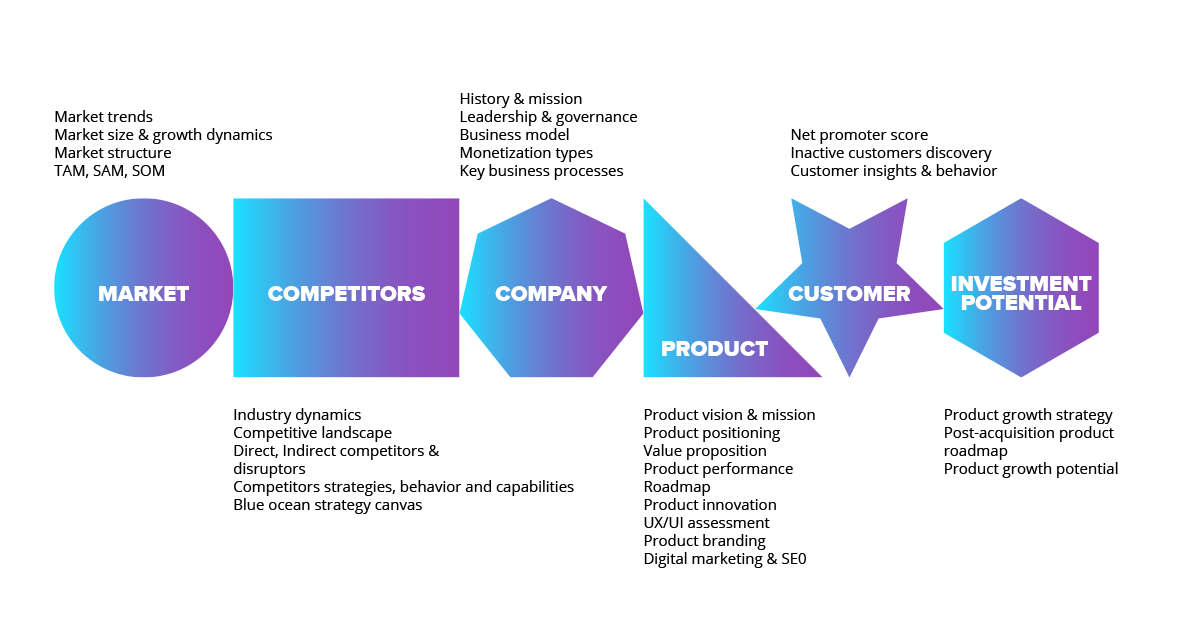

Product due diligence is the process of assessing a target product’s potential from several key perspectives:

- Market analysis and opportunity

Understanding market trends, size, position, growth rate, and demand is essential to see how a product can attract and retain customers. A thorough market analysis helps uncover both strengths and weaknesses, shaping the product’s true potential. - Founder’s product vision

This involves evaluating the founder’s vision and mission — why the business model was chosen, how revenue streams are projected, and who the target audience is. For investors, it’s important to see if this vision truly addresses market needs and encourages customer adoption. - Product scope, design, maturity, and management

Is the product ready to compete as a leader? Assessment covers product management, operations, market relevance, value proposition, and both functional and non-functional capabilities. It also includes a review of innovation potential, the roadmap, and the product’s UI/UX. At SoftServe, we also analyze management processes through the lens of product development history to understand how the product has evolved. - Competitive landscape

Profit potential must be weighed against competitors. Investors look for ways to differentiate the product and create new value for existing and future customers. Beyond competing in a crowded Red Ocean, Blue Ocean strategies can re-segment or expand mature markets, unlocking new growth opportunities. - Emerging technology

Market trends shift quickly, and yesterday’s innovations can lose value fast. Investors need to know which emerging technologies can strengthen the product’s position and which tech trends could pose risks to its growth and profitability. - Customer acquisition and retention potential

This area looks at how well the product attracts new customers and keeps existing ones engaged. It examines usage patterns, satisfaction levels, and customer loyalty — often measured by how many are willing to recommend the product.

HOW TO HAVE A BETTER LOOK AT INVESTMENT POTENTIAL

After assessing the product from the perspectives above, the next step is to examine the post-acquisition roadmap, the growth strategy, and potential risks. Product due diligence goes beyond evaluating features in isolation.

The goal is to connect data into clear, structured documentation — flows, diagrams, and charts — that reveal how different elements depend on one another. These connections help identify the real causes of weaknesses and highlight opportunities to strengthen the product, giving investors a realistic view of its potential.

HOW SOFTSERVE APPROACHES THE DUE DILIGENCE PROCESS

Our experts evaluate a product from business, customer, and technical perspectives to build a complete picture of its current performance and growth potential. We use proven approaches like lean product management, design thinking, and service design to guide this value-focused assessment. Here’s how the process works.

Step 1: Gathering insights

The first stage focuses on gathering as much information as possible to understand the investment context, potential scenarios, risks, and the client’s expectations for the investment plan. SoftServe’s approach is built on gaining a clear picture of both external and internal factors that influence a product’s potential, as well as evaluating the likelihood that it will meet investment goals after acquisition.

Step 2: Aligning expectations

Managing expectations is essential to ensure both sides stay aligned and share a clear understanding of the investment. SoftServe takes responsibility for facilitating efficient communication with clients to keep the process transparent and focused on the end goal. Our experts provide forward-looking recommendations and present detailed, data-driven insights to support confident investment decisions.

Step 3: Expert team in action

Our due diligence process is led by principal and senior product strategists, product designers, and software architects with deep domain expertise. Throughout the assessment, we guide stakeholders through market and competitor analysis, in-depth customer interviews (active, inactive, and potential), code reviews, strategy and roadmap workshops, and growth-focused activities such as rapid prototyping and user testing.

Step 4: Actionable insights

The outcome of this process is a detailed report that includes recommendations, identified risks, and key findings based on a variety of analysis methods. Investors receive an in-depth view of the target company, its market position, and the factors influencing its ability to achieve projected results. This report provides the insights needed to make well-informed decisions by uncovering potential risks tied to the target business.

THE VALUE YOU GET WITH SOFTSERVE

Product due diligence is a critical part of any investment journey. It involves careful organization, coordination, and thorough analysis, collecting sensitive documents, researching markets and customers, collaborating with multiple stakeholders, and analyzing the data to support a successful deal.

At SoftServe, we help clients uncover potential risks and develop an optimal strategic roadmap to support future product growth and maximize investment success. Our approach is tailored to each investment’s unique context and requirements.

Since 1993, we’ve designed and built numerous digital products, from idea to launch, for leading ISVs and global enterprises. Over the years, our dedicated teams have gained practical experience and market-proven best practices, which we now apply to deliver high-value consulting services.

Let’s discuss how we can help you evaluate the investment potential of your high-tech target.

Start a conversation with us