AI and Analytics Key to Firms’ Ability to Meet ESG Data Challenges

The deployment of artificial intelligence (AI) and sophisticated analytics will be critical for firms that want to meet increasingly onerous ESG regulatory obligations. This was one of the key messages to emerge from participants at a recent conference on the subject.

The challenge to collect, analyse, and use data from multiple diverse sources for important decision-making was seen as a primary objective. But new guidelines and laws, particularly in the EU, as well as heightened expectations from shareholders, customers, and employees mean that urgent action will be required in these areas to deliver the required results.

The recent ESG Data & Tech Summit in London brought together top ESG specialists from the capital markets with data and technology solution providers to delve into how financial institutions can navigate this evolving ESG regulatory and market landscape. In the event’s keynote presentation, experts from SoftServe and the audience discussed the necessary data and technology strategies that organisations must adopt to tackle regulatory, data management, and reporting challenges on the path to net-zero.

Sustainable finance

Europe is at the forefront of integrating environmental, social, and governance (ESG) factors into corporate and financial sectors as part of the EU’s sustainable finance initiatives. In an already dynamic and multifaceted regulatory landscape within the financial services industry (FSI), discerning nuanced discrepancies has therefore become an even more intricate task. Participants emphasised the formidable challenge posed by the continually shifting regulatory environment, particularly access to and the integration of new technologies capable of delivering these results.

Key regulations, such as the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR), require around 50,000 companies to disclose their ESG impacts. This year the EU is advancing its sustainable finance agenda with the implementation of the SFDR and the EU taxonomy to steer capital towards sustainable activities. But more is in the pipeline.

The Corporate Sustainability Due Diligence Directive (CSDDD) mandates environmental and human rights due diligence across global operations, with continuing application dates between 2027 and 2029. Furthermore, the European Commission is proposing regulations for ESG rating services to enhance transparency and reliability, aiming for finalisation in 2024 and application in 2025.

ESG data readiness

Due to the extensive scope of these regulations and the limited timeframe for implementation, companies are encouraged to initiate preparations now. This entails evaluating their existing sustainability reporting processes and making essential adaptations to ensure compliance with the updated standards. These are some of the key challenges:

- Access to high-quality ESG data: Challenges arise in accessing accurate and consistent ESG data across operations, necessitating robust data governance and technology solutions.

- Lack of standardisation: The absence of standardised and globalised ESG disclosure obligations hinders comparability across companies and sectors, highlighting the need for consistent taxonomies and disclosure standards.

- Embedding ESG into financial data: To consider ESG factors in investment decisions and risk management requires new methods to integrate ESG data with traditional financial analysis and risk models.

- No single source of truth: Financial organisations are having technical difficulties in collecting data from various data providers.

- Complexity of regulatory framework: The ever-changing mix of regulations and reporting frameworks for ESG creates difficulties for financial institutions.

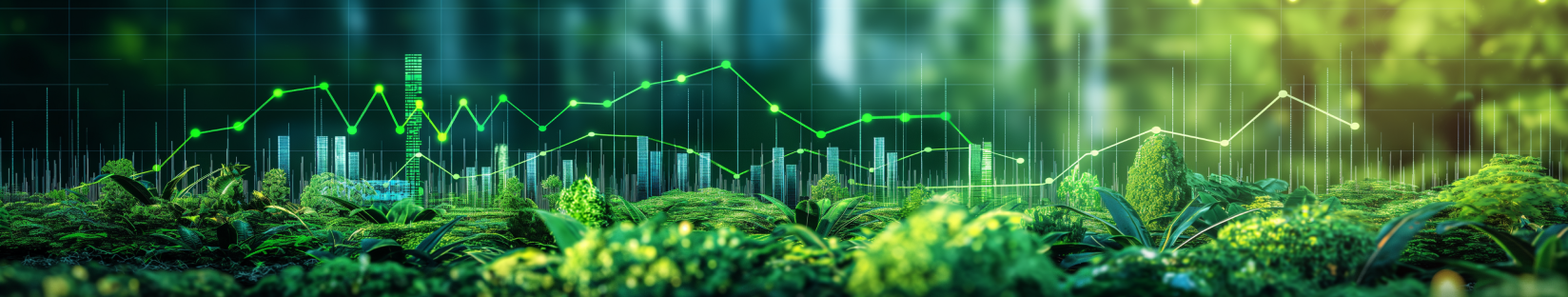

Top ESG data and technology concerns identified at the summit

Most participants identified sourcing data as their biggest concern, particularly the assessment of non-standard and unstructured ESG data within organisations. This was followed by issues with data quality, timeliness, and integration. When asked about the biggest ESG technology challenge, the top response was combining and analysing structured and unstructured data, with the integration of ESG goals and performance into risk management close behind.

Implementing technology for ESG-driven approaches

It is clear that new technology and data analytics have the capacity to transform ESG strategies for financial institutions. The use of AI and advanced analytics enables financial organisations to optimise resources and make smarter investment choices. AI plays a pivotal role in standardising ESG data and reports, analysing large volumes of structured and unstructured data through sentiment analysis and natural language processing (NLP).

This not only helps to identify trends and early warnings but also provides investors with a clearer understanding of companies' performance and potential risks. By employing machine learning and NLP, banks and asset managers can address the challenge of using unstructured ESG data, to extract valuable insights from regulatory filings and corporate documents that will generate comprehensive ESG scores.

Customised solutions

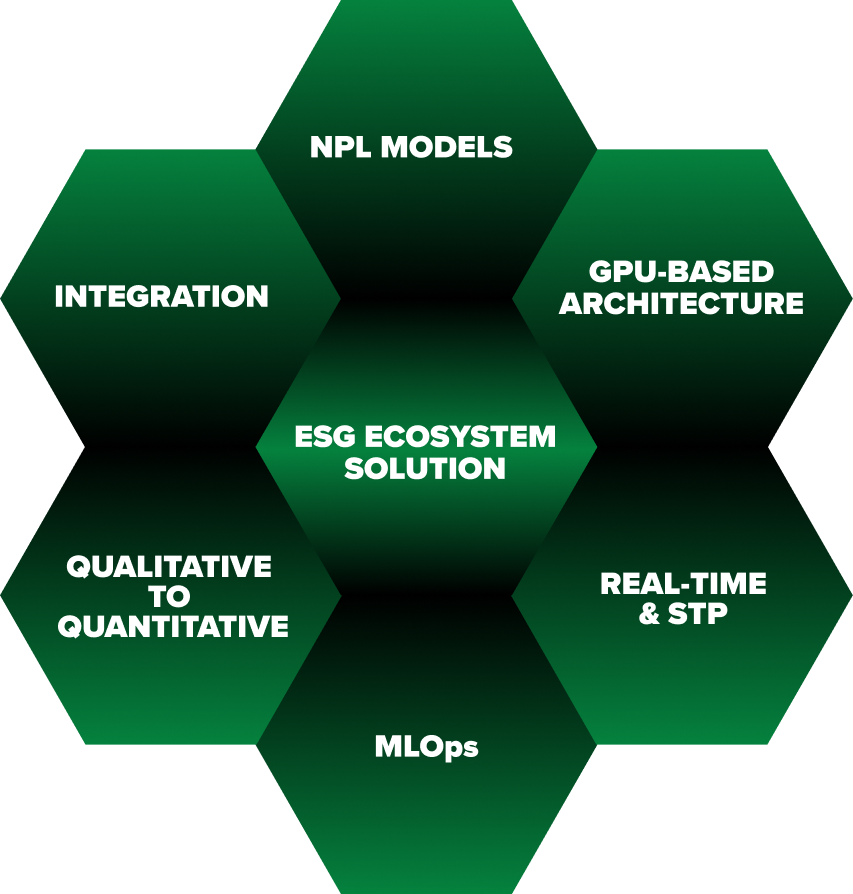

To demonstrate how this could work in practise, SoftServe showcased its ESG data platform at the summit, unveiling innovative AI-driven solutions tailored for asset managers. The ESG ecosystem solution streamlines data gathering by integrating structured and unstructured data through MDPs, scrapers, and APIs. Leveraging AI, Gen AI, and ML models. It also translates ESG rating changes into actionable price and risk values for investments.

The platform utilises NLP models to extract and analyse ESG-related information, while IDP technology converts complex, unstructured documents into structured, usable ESG data. This proven solution supports and strengthens real-time decision-making, empowering asset managers with enhanced efficiency and insights.

It is an approach that can be easily customised to work with organisations’ existing technology infrastructure, by enhancing current capabilities with minimum disruption. It can integrate the deployment of powerful AI tools with the installed base, as our expert engineering teams work alongside internal resources to deliver optimum outcomes. Speak to us about an initial rapid IT assessment to discover how this could work for your organisation.