Don't want to miss a thing?

Finance Firms Need Smart Tech & Smarter Processes for More Robust Cybersecurity

Threats of increasingly complex cybersecurity risks and fraud attacks are encouraging more financial institutions to explore new tools like Generative AI-led solutions to bolster their defences. However, as we will show, there also needs to be a rigorous adoption of more sophisticated working practises to keep organisations safe.

A recent feature in Fintech Times* said new AI technology is better able to identify fraud, assess risk, and provide resilient customer services at much faster speeds than before. This offers banks and insurers a robust defence against bad actors, many who have been seen deploying AI capabilities to attack these businesses and their customers.

In that article, we also highlighted the threat of regulatory fines, which have more than tripled in recent years. This has focused executive attention on the issue, as some €1.6 billion was levied in fines in the first five months of 2023, more than the combined total issued during 2019–22.

Multifaceted approach

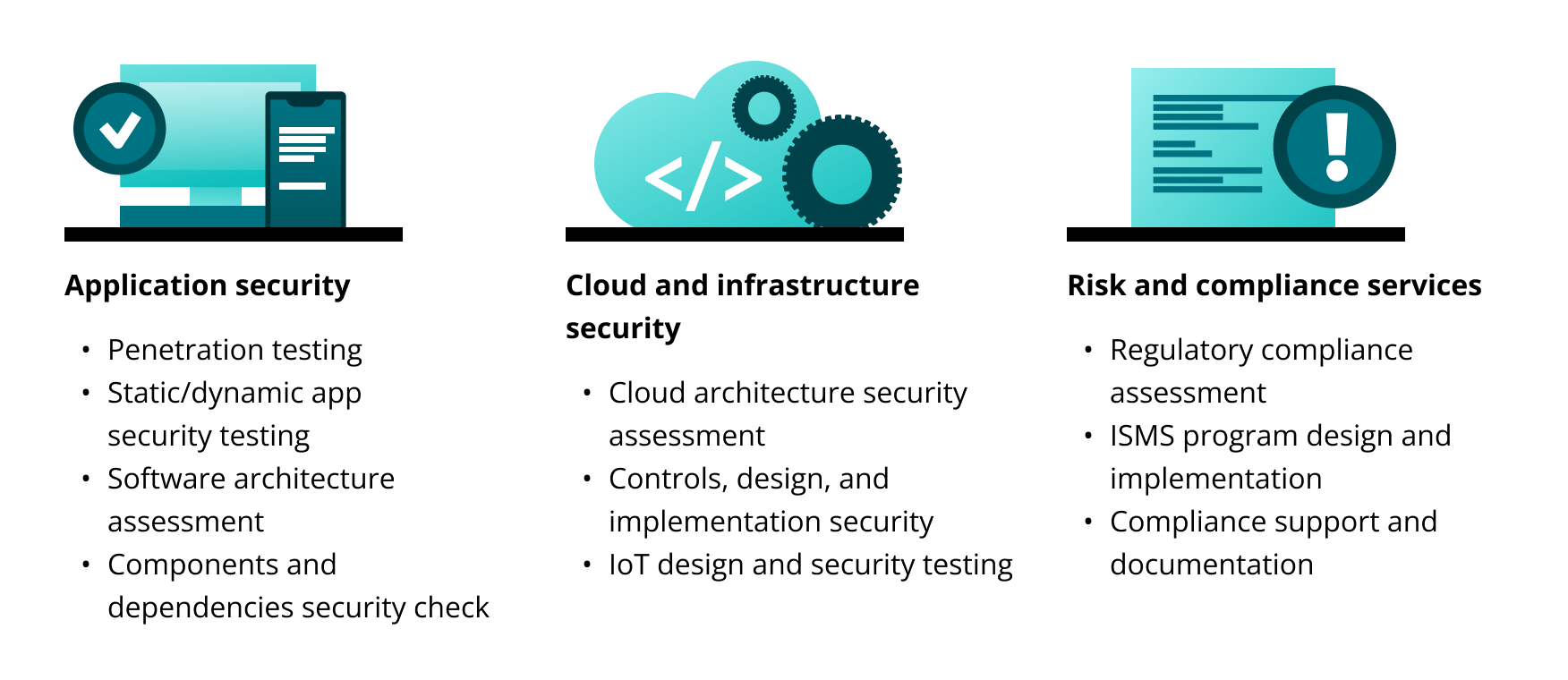

For this to be successful, firms need to adopt a multifaceted approach. These should cover a wide range of areas, processes, and involve the following steps:

Working with clients to deliver this level of scrutiny and support, SoftServe can guide firms through risks to their core services. These services combine various techniques, processes, and tools to assess the real-world exploitation of identified threat exposures by potential attackers. This ensures a thorough evaluation of the response of protection systems and processes in such scenarios.

The business benefits include cost savings from the implementation of preventive security measures, a transparent picture of the current security ecosystem, and a risk reduction that strengthens customer trust and loyalty. More importantly, a robust cybersecurity ecosystem that keeps the business compliant with security regulations.

The Fintech Times article added that while cybersecurity professionals understand the importance of analysing risks holistically, many organisations have not applied this approach to their fraud practises. Consequently, fraud prevention teams may invest heavily in preventing fraudulent transactions, but without aligning these efforts with robust account protection frameworks, vulnerabilities can persist.

The article further noted that a winning fraud prevention mindset must extend beyond perimeter security. It has to continuously monitor customer transactions to detect and prevent takeover attempts and irregularities. This level of proactive defence is becoming the minimum standard required.

Continuous monitoring

Greater cross-organisational communication is required to deliver continuous monitoring and protection to prevent disparate, siloed activity between fraud prevention and cybersecurity.

The priority for finance firms should therefore be to create responsive ecosystems that improve organisational readiness. This is enhanced by restructuring approach points to solutions that create greater attack coverage, and rebalancing practises to focus equally on people, processes, and technology.

Many firms are accordingly developing an increased interest in AI/ML security to augment more traditional defences. By doing this, AI is introduced as an advanced way of addressing risks and threats. Its ability to analyse large sets of data opens the opportunity to not only protect, block, and prevent risks, but also more accurately manage them.

There is little doubt that fraud and other cybercrime activities are becoming more sophisticated, with a constantly changing technology landscape creating new threats. It is therefore critical for firms to have regular security assessments and validations to ensure ongoing risk mitigation and monitoring of implemented strategies. GenAI can certainly play a significant role in this by automating many of the key processes.