Don't want to miss a thing?

How mid-size banks and payment processors keep up with technologies to win customers

As payment technologies keep evolving, customers gladly embrace new experiences and adopt new digital behaviors. The challenge for businesses is, how do they keep up with the pace of change without inviting disaster? Businesses that fail to provide suitable payment methods face the risk of falling behind and losing revenue.

Mid-size banks and payment processors respond to this challenge by investing heavily in re-platforming payment systems and updating infrastructure while often looking for a solid fintech solution to acquire. But what is the best way to make this shift?

In this article, we'll review the evolution of the payments infrastructure and offer an approach to building a proven payment architecture.

Evolution of payments infrastructure

Updating legacy payment technology in fact means modernizing its key aspects:

- Installations and infrastructure that includes data, communication, the system of record, and tokenization.

- Routing, analytics, risks, authorization, and instruments that are part of the middleware ecosystem

- Customer experience, distributed point-of-sale solutions, financial tools related to the front-end channels, and execution systems.

These payment technology aspects have continuously changed since the first card-based payment. To better understand current and future trends, let's explore the evolution of payment infrastructure.

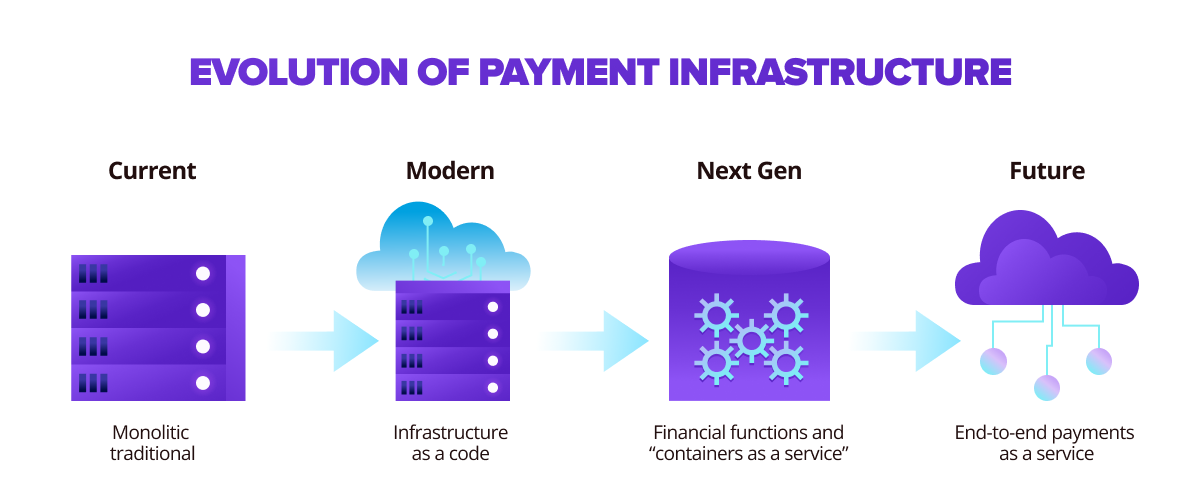

Picture 1: Evolution of payment infrastructure

Thirty years ago, card platforms relied on proprietary, monolithic infrastructure that was costly to manage and develop. This made it nearly impossible for small firms to enter the market space.

By the early 2010s, PayPal, a decade-old company at that time, was processing more than $350 billion in payments yearly. Back then, fintech companies such as Stripe, Square, and Adyen disrupted the industry using open-source technology, decentralization, and cloud computing advances, enabling flexibility and on-demand capacity provisioning.

Later, the "financial functions as a service" and "container as a service" era arrived. Today, building adaptable, fully automated systems have never been more accessible. It is now easier to apply deep learning to numerous workflows, such as streamlining credit judgments, reducing rates, optimizing stand-ins and authorization rates, and minimizing declines, which became possible due to the rise of open-source technologies.

We anticipate that a fully automated and optimized "payments as a service" (PaaS) solution will become the future of payments. Currently, on-demand tokenization and routing are codified as separate functions, assembled and extended in a Lego-like fashion to provide a superior customer and cardholder experience. Apple's payment wheel is a recent example. However, PaaS can also offer a tailored end-to-end design with features like dynamic CVV, token switching, and backward compatibility.

These adaptable, modular, and automated systems have paved the way for the rapid adoption of cutting-edge technologies like blockchain, DAG3, and AI, which will power the next generation of card and payment technology.

Let's look at how some of these technologies are altering the payments landscape and structure of traditional platform architectures.

Five technologies altering the payments landscape

1. Blockchain

Distributed ledger technology makes certain forms of payments more cost-effective, secure, and traceable in most commercial use cases. Blockchain provides near-instant and transparent prices in the competitive cross-border payments market, removing complex and opaque fee structures.

Because of blockchain's distributed, consensus-based, and real-time transaction verification, it's challenging to defraud systems using it. The technology also allows for higher transaction-per-second throughput and faster settlement compared to traditional card-based systems.

There are still technological and legislative roadblocks to overcome before broad blockchain use, but the potential is undeniable.

2. Deep Learning and Artificial Intelligence

With the democratization of data and neural networks, it's more important than ever for card issuers and payment providers to use artificial intelligence (AI) and deep learning (DL) to institutionalize next-generation fraud monitoring and anti-money laundering (AML). However, delivering value through higher approval rates, fewer declined transactions, and proactive credit limit management is no less critical.

For example, Visa utilized AI/ML models to look for fraud indications in over 500 transaction variables in real-time, preventing $25 billion in fraud in 2019. RetailMeNot is an example of a company that combines DL and personalization to recommend targeted products at attractive prices to customers, enabling straight-through payments for purchases.

AI also opens new income and monetization opportunities for merchants and advertisers. They can access on-demand and real-time analytics, deep data monetization, and effective pricing and promotion support.

3. Internet of Things (IoT)

The payments card sector is vulnerable to upheaval due to increased connectivity, device penetration, and embedded payments. The need for physical cards and account numbers is being questioned, given the quantity of information transmitted between devices.

Companies are experimenting with biometrics-based payments. For example, in October 2021, Amazon Go tested a contactless identity service, combining users' credit cards with their palm prints to produce a unique biometric signature. Customers can pay in a store by holding an Amazon One gadget in their palm.

Another example is a BioLock card security solution developed by SoftServe. Payment Card Bio-Authentication uses cutting-edge technology to measure, identify and record individual parameters of the human body's resistance to electrical currents. This technology is known as Bioelectrical Impedance Analysis (BIA). BIA technology powers BioLock by analyzing unique bio body characteristics to authenticate the card holder's true identity.

Even smartwatches can now safely share information (through device account numbers or DANs4) with adjacent systems to process payments on-demand using tokenization. Moreover, back-end token swapping can boost value even more by enabling real-time switching between several accounts.

4. DLT+IoT

Combined with blockchain, embedded IoT systems could one day serve as decentralized credit-card processing platforms. Allowing a consumer's digital ID to be used as a key for payment execution has already reduced the value of plastic cards.

5. Multi-dimensional instruments

Banks can now use a reference account number and back-end token swapping to dynamically link the reference account to various PANs with the help of functional architectures. Banks issue a single number that can be used for both credit and debit accounts (within legal limits) and new tenders, like digital money.

Customers can attach credit and debit cards to a single physical Curve card—for example, via a mobile app using the Curve "smart" card. They switch between cards before making a transaction or modify the card they selected after purchase for up to fourteen days.

Even though multi-function instruments are still in their infancy, several payments companies are developing them as the next generation of digital wallets, based on the functional mapping of back-end capabilities.

Although these technologies are still in early phases, they have the potential to spark considerable change. Payment providers can tackle the disruptor challenge and introduce new products and services more swiftly by adjusting and investing in updating the architecture of existing platforms.

Building proven payment architecture

Building new payment platforms and enabling integrations to services wouldn't be possible without solid payment architecture.

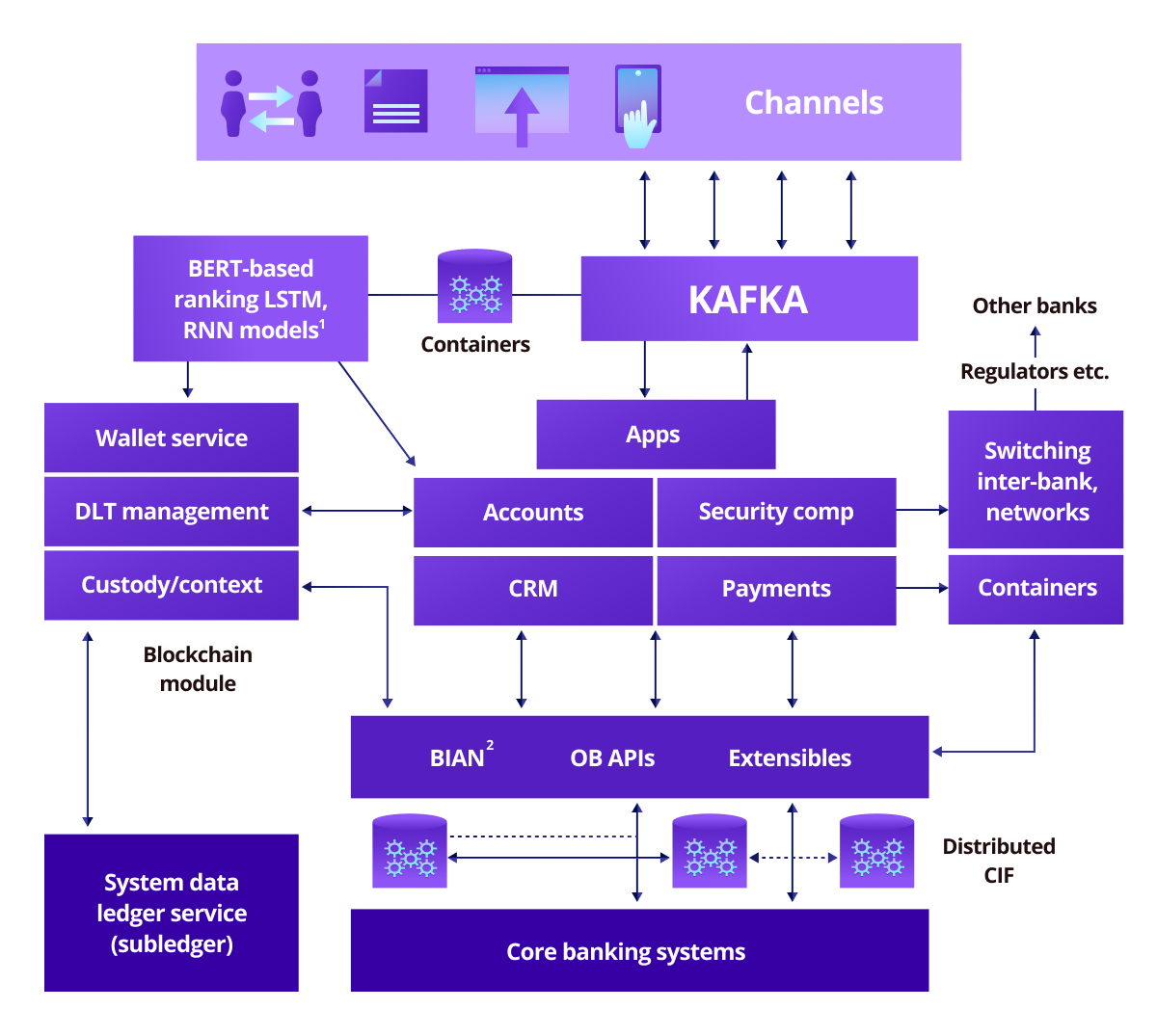

The architecture can include, for example, real-time RNN6-powered feed-forward networks that help improve channel experience, expedite and consolidate client payment experiences, and even provide real-time financial advising and education. The standard design would allow for a segmented blockchain-based extension with existing core banking platforms to launch credit cards for better cross-border payments, lowering total costs and increasing security.

Below is an example of a high-level reference architecture that efficiently implements new technologies and capabilities.

The technologies we highlight here create intriguing opportunities. Forward-thinking payment players will recognize the potential and plan for the next wave of payment innovation. However, these acceleration activities also require preparatory work

Starting a modernization journey

Preparation is of the essence when modernizing payment architecture. Here are questions to ask that help businesses save time, money, and resources, before setting on this journey:

- Does an upgraded solution for infrastructure and platform help accelerate extending payments services, introduce new products, and allow for scaling and enhanced efficiency?

- Is a new payment platform able to decouple legacy workflows and replace them with new ones based on blockchain, AI, and IoT?

- Will the current architecture, operational model, and business strategy work and scale across general standards (e.g., ISO, PCI)? Will they connect to future-generation third parties like digital cryptocurrency exchanges?

- Can a current infrastructure adapt to legislative and institutional changes in response to the upcoming challenges associated with real-time payments, new communication standards, fraud, and privacy requirements)?

Don't let profits and customer satisfaction melt away because of inefficient technology! Let’s talk about how SoftServe can help update your payment infrastructure to win and retain customers.